Adecco Group Q3 2024 Financial Results: Resilient Performance Amid Market Headwinds, Revenue Decline of 5%

Adecco Group's Q3 2024 revenue saw a 5% decline on an organic and trading days adjusted basis, attributed to a challenging macroeconomic environment and sectoral pressures, particularly in logistics, healthcare, and manufacturing. The company’s gross profit dropped 8%, and EBITA, excluding one-offs, fell by 20% in constant currency. Regionally, performance was mixed, with growth in APAC and Latin America but declines in Europe and the U.S. Despite the challenging environment, CEO Denis Machuel highlighted stable volume trends and progress in cost-saving initiatives. The group is focused on expanding AI-driven solutions and strengthening Global Delivery to enhance productivity and capture future growth.

Zurich, Switzerland

Zurich, Switzerland —

November 5, 2024 — Adecco Group, a global leader in talent solutions, today reported its third-quarter 2024 financial results. Amid challenging market conditions, Adecco delivered a robust performance, aided by strategic cost-saving initiatives and volume stabilization efforts, despite an overall revenue decline.

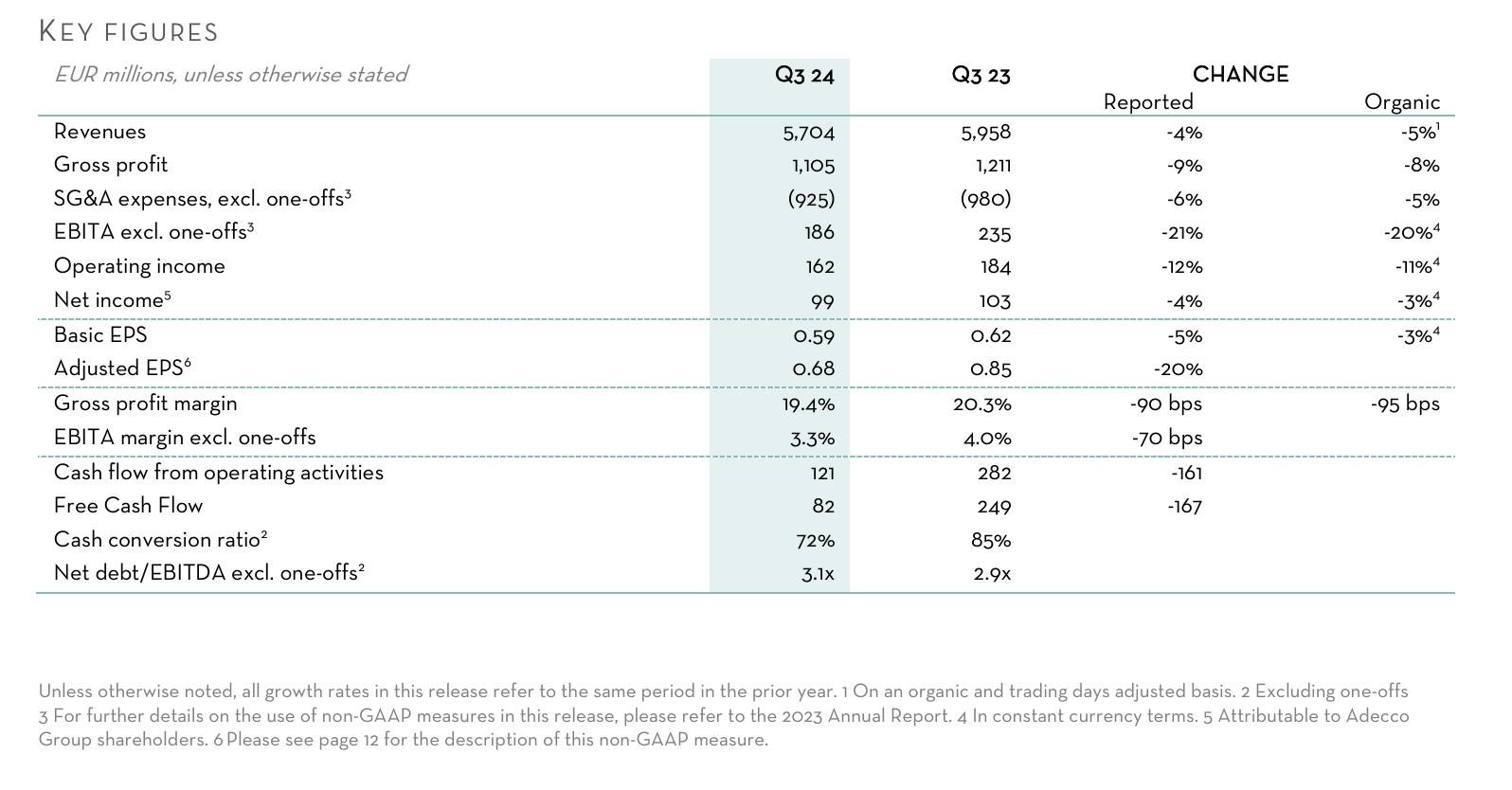

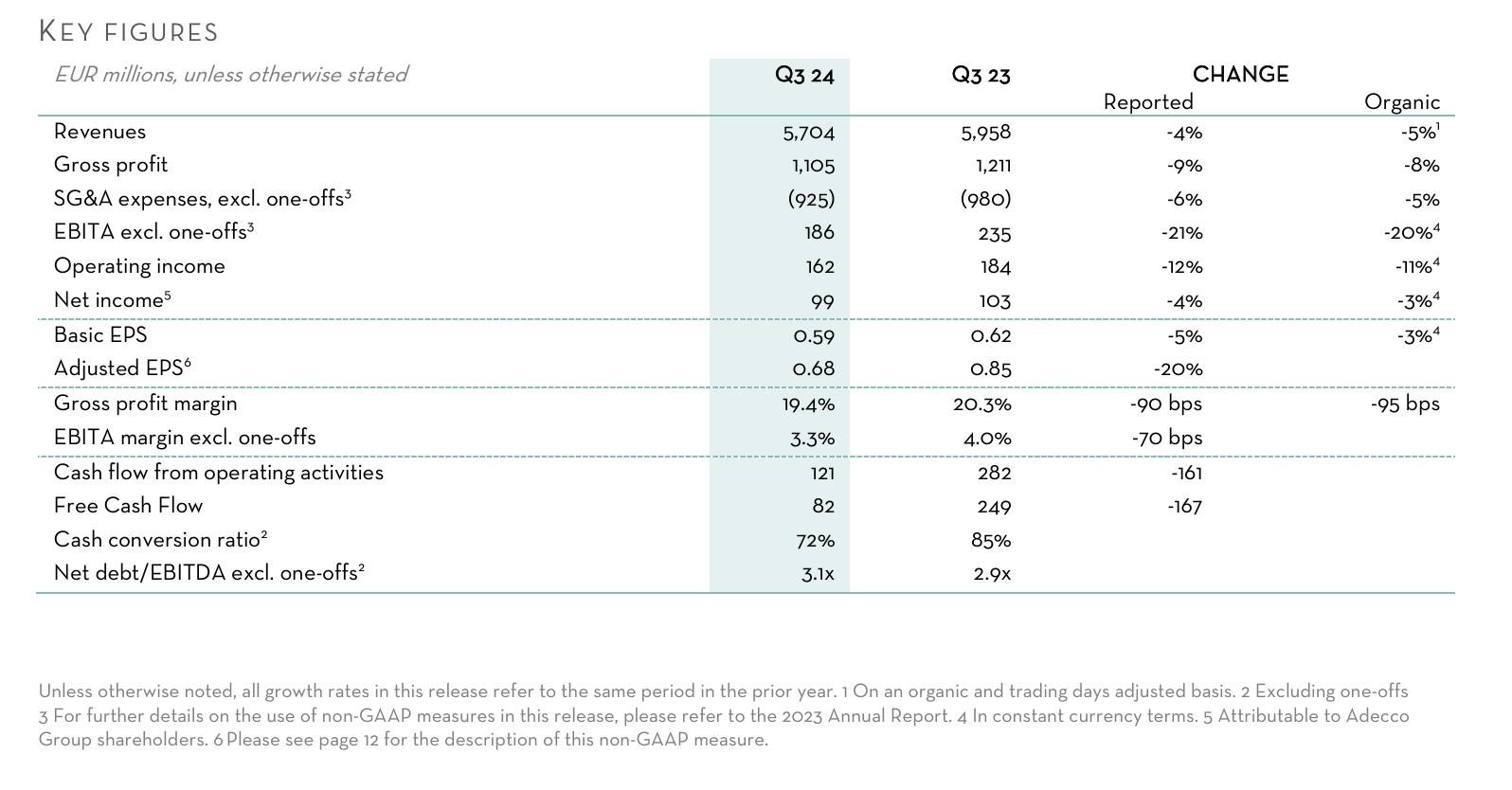

Key Financial Highlights

- Revenue: EUR 5.7 billion, down 5% on an organic basis adjusted for trading days, reflecting the ongoing impact of economic headwinds in key markets.

- Gross Profit Margin: 19.4%, remaining stable quarter-on-quarter despite reduced volumes and a challenging business mix.

- SG&A Expenses: EUR 925 million (excluding one-off items), representing a 5% year-on-year reduction due to ongoing cost-control measures.

- EBITA Margin: 3.3%, a resilient outcome supported by general and administrative (G&A) savings and strategic focus on capacity preservation in key sales areas.

- Net Income: EUR 99 million, down 4% year-on-year, with Basic EPS at EUR 0.59 and Adjusted EPS at EUR 0.68.

- Operating Cash Flow: EUR 121 million, with year-to-date free cash flow of EUR 117 million, an increase over the previous year.

Business Unit Performance

Business Unit Performance

- Adecco (Core Staffing Solutions):

- Revenue declined by 5% on an organic, trading days-adjusted basis. Performance was strong in APAC, Iberia, EEMENA, and Latin America, though these gains were offset by challenging conditions in France and the US.

- By service line, Flexible Placement revenue was down 5%, Permanent Placement fell by 9%, and Career Transition dropped by 9%. Outsourcing, Consulting, and Other Services rose by 3%, indicating a steady demand for project-based and advisory solutions.

- Akkodis (Digital and Engineering Solutions):

- Revenues fell by 5% on an organic basis, though Consulting and Solutions services grew by 2%.

- Regionally, North America was hardest hit with a 15% decline in revenue due to a tech staffing slowdown, while APAC regions saw growth of 9%, bolstered by strong demand in Japan and China.

- The EBITA margin for Akkodis was 5.1%, reflecting the impact of lower staffing volumes partially offset by successful cost reduction initiatives.

- LHH (HR Transformation and Career Development):

- Revenue declined by 7% year-over-year, with mixed results across services. Recruitment Solutions fell by 10%, Career Transition and Mobility by 10%, and Learning & Development by 7%. However, Direct Sourcing within the Pontoon segment showed an 8% increase, and Ezra's revenue surged by 29%.

- The EBITA margin was 6.0%, affected by the shift in service demand, particularly in Career Transition, though strong G&A savings helped mitigate this impact.

CEO Commentary

CEO Commentary

Denis Machuel, CEO of Adecco Group, stated, “We continue to see the benefits of our ‘Simplify, Execute, Grow’ plan, reflected in our solid third-quarter performance amid economic headwinds. While the macro environment remains difficult, I’m encouraged by signs of stabilization in our business volumes. Enhanced G&A savings and a reprioritization of our IT and digital strategy, including accelerated AI adoption, are enabling us to support our clients effectively while positioning ourselves for future growth.”

Outlook

The Adecco Group anticipates fourth-quarter results in line with Q3, with similar revenue performance, gross margin, and SG&A ratios. Management is focused on increasing G&A savings while safeguarding key areas to capture future market growth. Year-end net debt is expected to remain consistent with prior-year levels.

About Adecco Group

As a world leader in talent solutions, the Adecco Group’s mission is to make the future work for everyone. Operating across 60 countries through its three core business units—Adecco, Akkodis, and LHH—the Group fosters sustainable and lifelong employability, powers digital and engineering transformations, and supports organizations in workforce optimization. Adecco Group AG is headquartered in Zurich, Switzerland (ISIN: CH0012138605) and is listed on the SIX Swiss Exchange (ADEN).

For additional information, please contact the Adecco Group Investor Relations and Media teams.