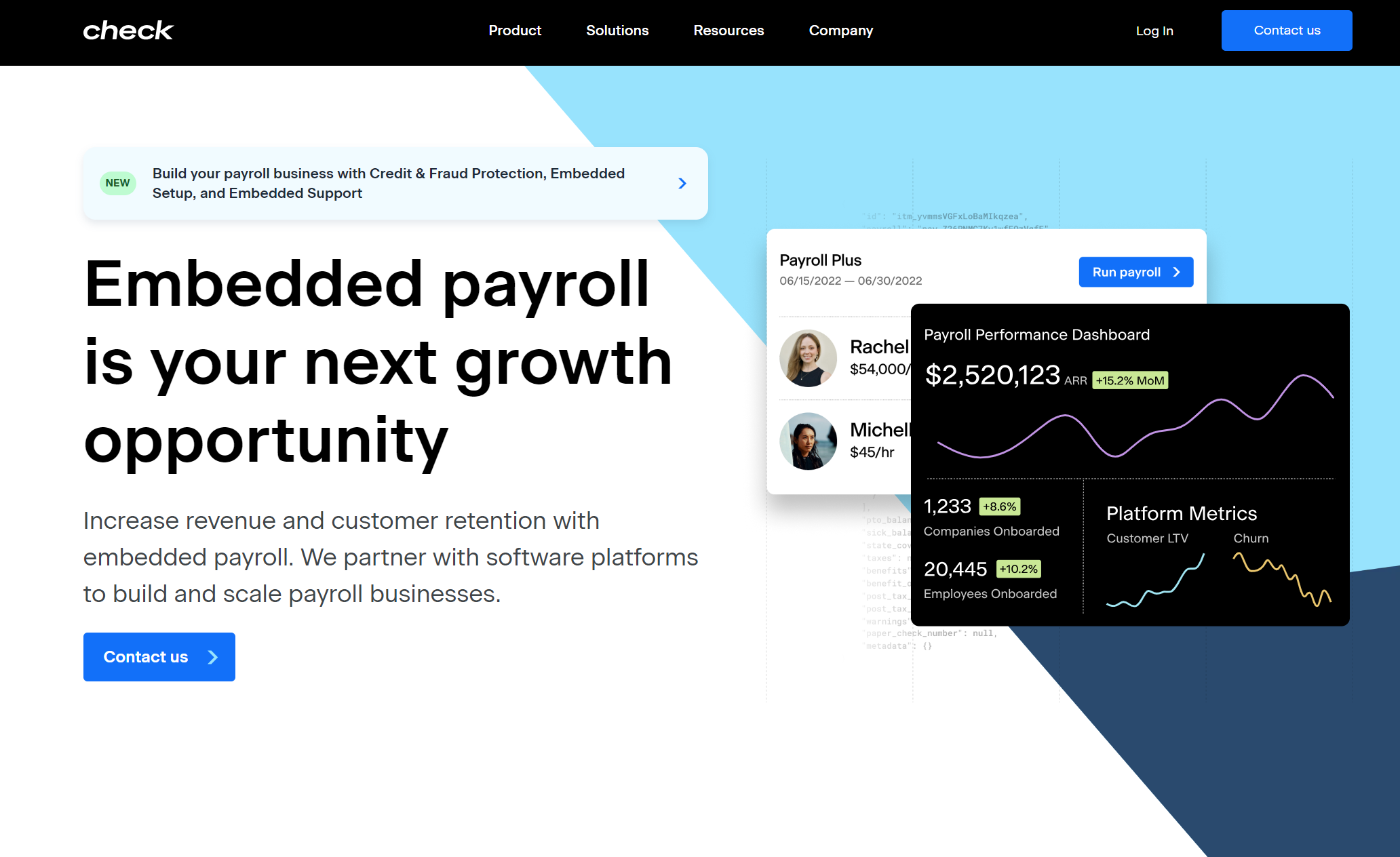

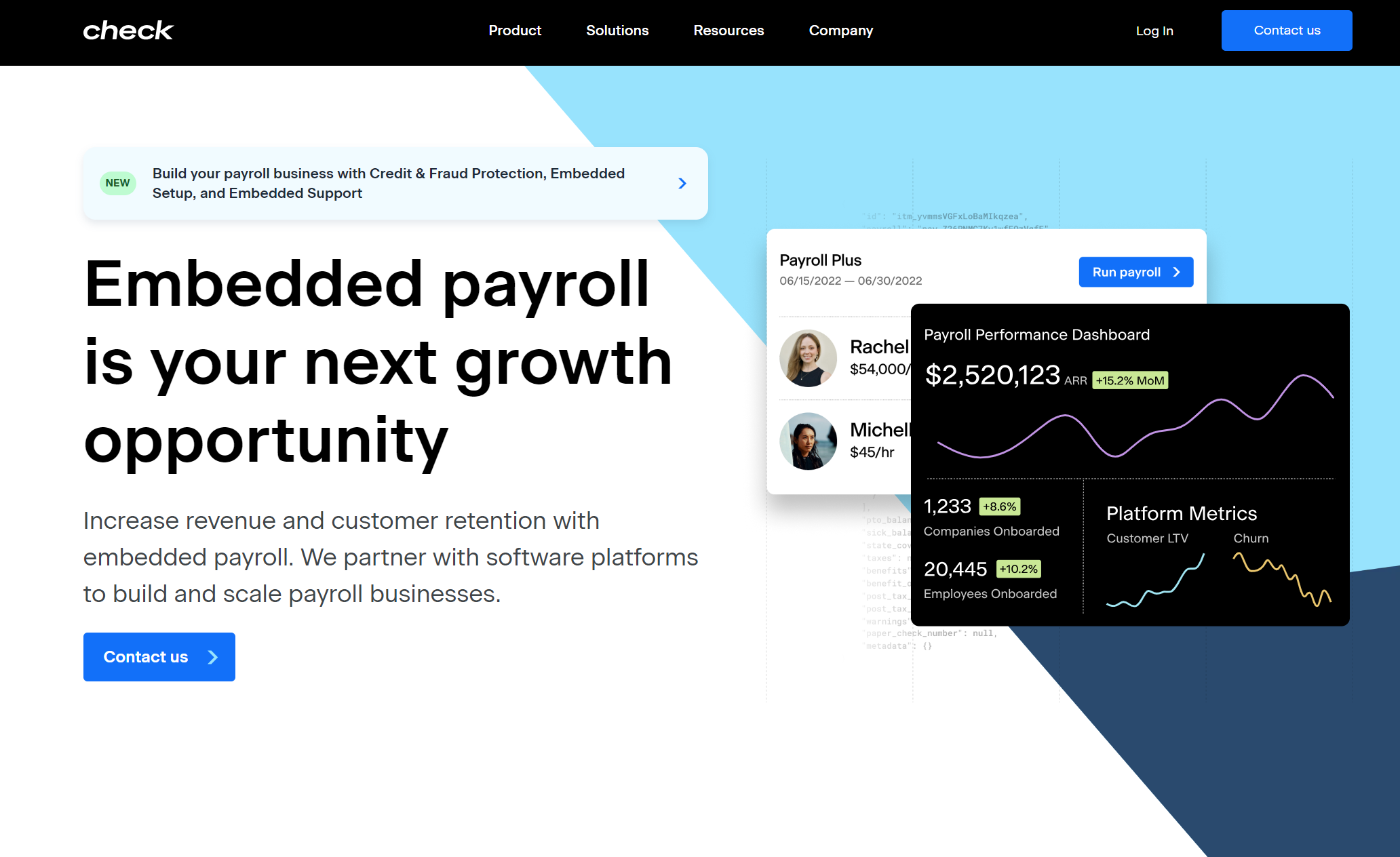

Check Launches New Tools to Help Organizations Build and Scale Payroll Businesses

Check, a pioneer in embedded payroll, has launched innovative tools to assist organizations in establishing and expanding their payroll businesses. These tools include Credit & Fraud Protection, Embedded Setup, and Embedded Support. These solutions aim to address critical challenges in payroll business, such as fraud management, data migration, compliance, and support. The CEO of Check, Andrew Brown, highlights that these tools simplify the complex aspects of payroll management, thereby reducing risks and improving unit economics. Check's offerings ensure efficient data transfer and real-time support, making payroll processes more seamless and less burdensome for companies.

NEW YORK

Check, the pioneer of embedded payroll, today announced the launch of a set of category-defining innovations: Credit & Fraud Protection, Embedded Setup and Embedded Support. Combined with Check’s core embedded payroll API and Check Components, these new offerings help platforms address the most challenging issues surrounding launching a payroll business, including fraud management and detection, data migration, compliance and support.

“Our new tools represent a major shift in the evolution of embedded finance and payroll,” said Andrew Brown, CEO and co-founder of Check. “Something as complex as payroll requires a tremendous amount of time and resources to properly design and execute – you can give businesses the technical components to build it, but you can’t just send them out to sea to run it. With our new suite of offerings, we’ve identified the most complicated aspects of launching and operating a payroll business and eliminated them. Through this, we’re able to provide more than just embedded tech; we’re providing a fully embeddable business line with better unit economics and markedly less risk.”

Payroll fraud is one of the most prevalent fraud schemes inside businesses: for small businesses, payroll fraud is twice as likely to occur as it is inside large organizations. With Check’s Credit & Fraud Protection, platforms don’t need to worry about the risks associated with running a payroll business. In addition to taking on all credit and fraud losses, Check provides credit underwriting to help employees get paid faster without delays. This enhanced tool also includes fraud monitoring and prevention services, encompassing suspicious activity reporting, enhanced due diligence and watchlist screening. Platforms remain completely out of the flow of funds without needing to build their own credit, fraud, compliance and regulatory teams.

Additionally, onboarding a customer to payroll is one of the most costly and outdated processes in the industry – it requires meticulous data transfer from one platform to another, taking weeks to complete. Embedded Setup is a new end-to-end offering for onboarding new or migrating existing employers to Check’s payroll product. It takes care of all company and employee data migration, including pay history, from any previous payroll provider. Check makes this process seamless by ensuring data is transferred accurately and efficiently, reducing the time it takes to onboard new employers and get them up-to-speed running payroll.

“Embedded Setup has been a fantastic addition to our overall go-to-market pay motions. It’s allowed us to scale faster to meet hyper demand after launching our payroll offering this year,” said Jeff Imm, GM of Pay at 7shifts. “Not only has it helped us drive adoption, but the speed, accuracy and innovation behind it has allowed us to focus resources in other key areas to make sure our customers have the best onboarding experience.”

Making sure employees get paid correctly, and on time, is obviously important to any business. With increasingly complex tax calculations, deduction rules and filing obligations, employers need quick, compassionate and reliable support from experienced payroll specialists to avoid the costly consequences of noncompliance. But hiring a dedicated payroll support team is tough, often expensive and comes with significant overhead. Check’s new offering, Embedded Support, provides a much-needed channel to answer employers’ payroll questions in real time, eliminating the need for platforms to staff a dedicated payroll support team. This allows organizations to focus on growth and maintain a high bar for customer satisfaction, while Check’s team of experts handle the tough questions and issues that can arise before, during and after payroll processing.

Credit & Fraud Protection, Embedded Setup and Embedded Support are available as of today. To learn more, visit

www.checkhq.com.

ABOUT CHECK

Check is the leading payroll platform that pioneered the ability for companies to differentiate and open up new revenue streams by embedding payroll into their platforms. Historically, complex regulatory structures stagnated payroll innovation, making it harder for businesses to create their own payroll offerings. By building on Check’s best in class infrastructure, flexible API, and deep expertise, platforms can launch profitable payroll businesses much faster, and with little overhead or administrative burden.

Since Check’s public launch in January 2021, leading vertical SaaS companies and large scale workforce management horizontal platforms have built successful payroll businesses on its infrastructure. Check’s partners collectively serve more than 250,000 businesses and over 4 million employees. Check is backed by Stripe, Thrive Capital, Index Ventures, and Bedrock.