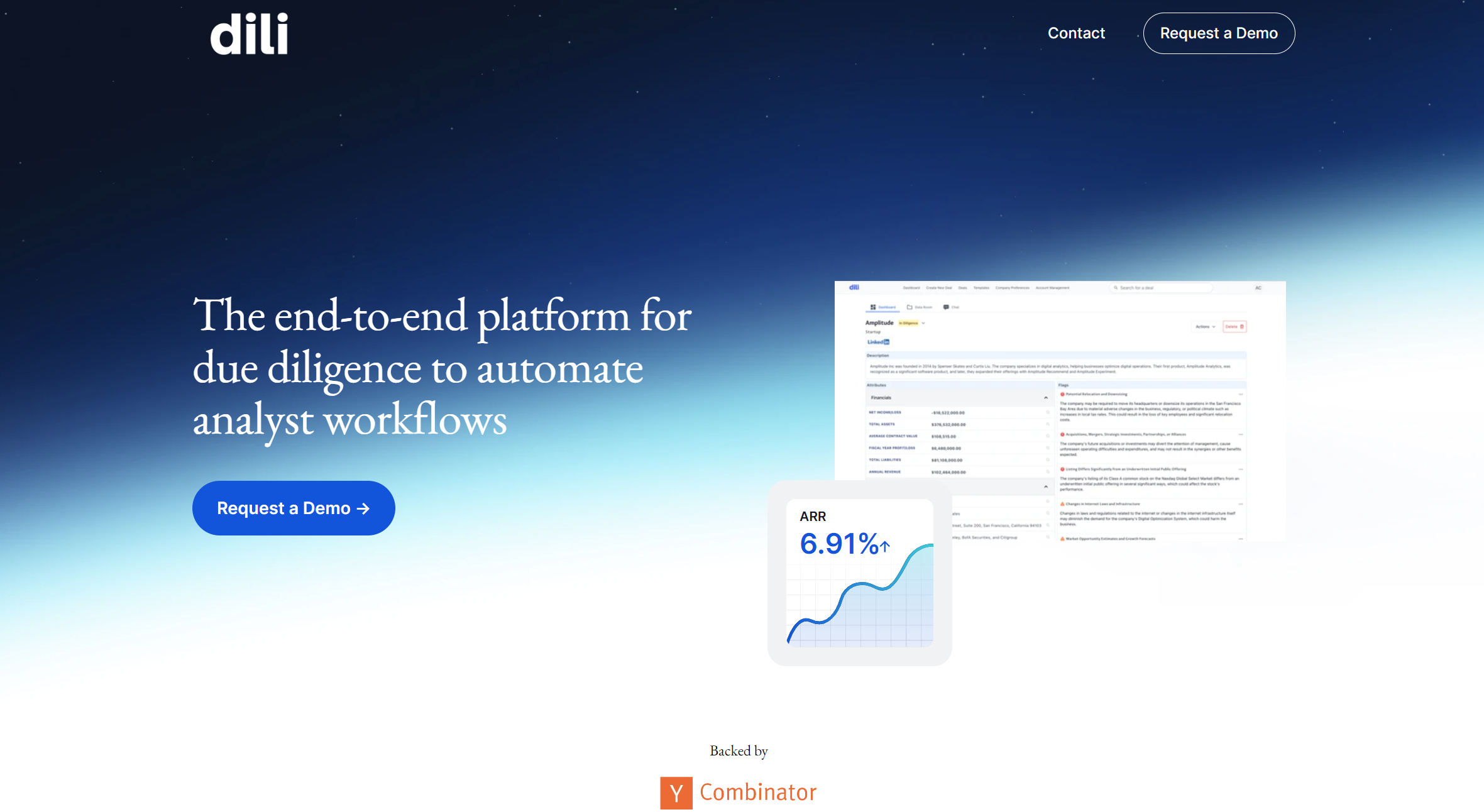

Dili Raises $3.6M from Top Investors to Automate VC Due Diligence with AI Innovation, Celebrates Y Combinator Heritage

Dili, co-founded by former Coinbase team members, aims to revolutionize the due diligence and portfolio management process for private equity and VC firms through AI automation. With $3.6 million in venture funding, Dili leverages generative AI, including technologies akin to OpenAI's ChatGPT, to automate investment analysis, enhance efficiency, and reduce operational costs. Despite the challenges of accuracy and bias inherent in AI, Dili's unique approach to custom indexing and retrieval systems promises high precision in financial analysis. As the venture capital sector seeks innovative solutions amidst cautious investment climates, Dili emerges as a potential game-changer, offering tools for deeper insights and streamlined workflows in investment decision-making.

In a significant move towards transforming the landscape of due diligence in venture capital and private equity,

Dili, an innovative startup co-founded by ex-Coinbase executives, has successfully raised $3.6 million in venture funding. This round of financing saw participation from a notable array of investors, including Allianz Strategic Investments, Rebel Fund, Singularity Capital, and several others, marking a robust vote of confidence in Dili's vision and technology.

Emerging from the prestigious accelerator Y Combinator,

Dili is on a mission to automate the traditionally labor-intensive and time-consuming due diligence processes with the help of artificial intelligence.

Stephanie Song, alongside her former Coinbase colleagues Brian Fernandez and Anand Chaturvedi, initiated

Dili to tackle the inefficiencies plaguing the investment workflows in private equity and VC firms.

The startup's approach involves leveraging generative AI technologies, such as those similar to OpenAI's ChatGPT, to streamline investment analysis, reduce operational costs, and significantly enhance the efficiency of investment teams. Dili's platform is designed to automate key investment due diligence and portfolio management steps by creating a knowledge base of a fund's historical financial data and investment decisions. This AI-driven system aims to parse databases of private company data, manage due diligence request lists, and uncover obscure financial metrics with unprecedented accuracy.

Dili's unique proposition lies in its custom indexing and retrieval pipelines, fine-tuned for extracting financial metrics from vast unstructured documents with high precision. This breakthrough has the potential to provide investment professionals with a differentiated edge in decision-making, especially in a challenging macro environment where funds are increasingly cautious about deploying capital.

Despite the promising advantages of AI in investment analysis, concerns about accuracy, bias, and confidentiality remain prevalent. Dili addresses these challenges head-on by continuously refining its models to reduce instances of misinformation and bias. Moreover, the startup emphasizes the importance of privacy, assuring that private customer data is not utilized for training its models. Plans are also in place to enable funds to develop their own models using proprietary data, ensuring confidentiality and customization.

As venture capital firms navigate through a cautious investment landscape, with $311 billion in unspent cash and a seven-year low in fundraising, Dili's AI-powered solutions offer a beacon of hope. The startup's technology not only promises to unlock the untapped potential of private market data but also aims to redefine the standards of due diligence and investment analysis for the better.

With its recent funding, Dili is poised for growth, planning to expand its team and enhance its platform with new capabilities. The startup's vision of becoming an end-to-end solution for investor due diligence and portfolio management is well underway, with the potential to significantly impact how investments are evaluated and decisions made in the future.