Fiverr International Ltd. reported robust financial performance for 2023, exceeding its set targets for revenue and Adjusted EBITDA. The company's strategic focus on AI integration and expanding its complex service offerings significantly contributed to a 4% increase in GMV. Additionally, a notable expansion in the take rate was achieved through the success of Promoted Gigs and Seller Plus programs. With the recent launch of its Winter Product Release, Fiverr introduced major platform enhancements, including Fiverr NeoTM and AI-driven features, aiming to supercharge its ecosystem. As it moves into 2024, Fiverr is poised for accelerated GMV growth, focusing on market share expansion in complex services, adoption of Fiverr Business Solutions, and continuous AI-driven innovation.

- Delivered strong results for 2023. We successfully executed our strategic priorities and surpassed both revenue and Adjusted EBITDA targets that we set at the beginning of the year.

- AI drove a +4% uplift in GMV. Our investments in AI and highly skilled categories led to a 4% net positive impact on GMV in 2023. Complex services contributed to 32% of total GMV in 2023, with y/y growth of 29%, accelerating from 12% in 2022.

- Strong expansion in take rate. Take rate grew 160 bps in 2023 to 31.8%, driven by both Promoted Gigs, which grew 80% y/y in revenue, and Seller Plus, which grew 2.5x in revenue.

- Supercharged our platform with AI innovation. In our recent Winter Product Release, announced on January 30, we delivered major upgrades across our platform with the latest AI technology. This includes a brand new homepage with Fiverr NeoTM and AI-powered personalization, AI-assisted briefing capability, and a new AI-driven seller leveling system.

- Expect GMV to accelerate in 2024. Key priorities in 2024 include expanding our market share in complex service categories, driving adoption of Fiverr Business Solutions, and continued innovation around AI. We expect to take a balanced approach to drive profitable growth in 2024, with accelerating GMV, sustainable take rate, and continued expansion in Adjusted EBITDA.

NEW YORK, Feb. 22, 2024 Fiverr International Ltd. (NYSE: FVRR), the company that is changing how the world works together, today reported financial results for the fourth quarter and full year 2023. Complete operating results and management commentary can be found in the Company’s shareholder letter, which is posted to its investor relations website at

investors.fiverr.com.

“We are pleased to deliver strong results for 2023 with both revenue and Adjusted EBITDA ahead of our targets set at the beginning of the year. In the face of an uncertain macro environment, we continue to lead through innovation. Our latest Winter Product Release announced on January 30 is jam-packed with new products and features, with AI integrated across the platform,” said Micha Kaufman, Fiverr’s Founder and CEO. “We entered 2024 with great confidence that we will continue to deliver profitable growth, expand our market share in the digital services industry, and create long lasting values for both our community and our shareholders.”

Ofer Katz, President and CFO at Fiverr, added, “For 2023, we successfully executed our strategy of strengthening core marketplace, moving upmarket and investing in AI, while diligently managing our expenses. When top-of-funnel acquisition is expensive, we leaned inward by maintaining strong marketing efficiency, generating more revenue from repeat business, and continuing to expand our wallet share with our customers. We more than doubled our Adjusted EBITDA margin in 2023, and achieved annual GAAP profitability for the first time in our history. For 2024, we expect to accelerate our GMV growth with sustainable take rate, and continue to make steady pace in improving our bottom line.”

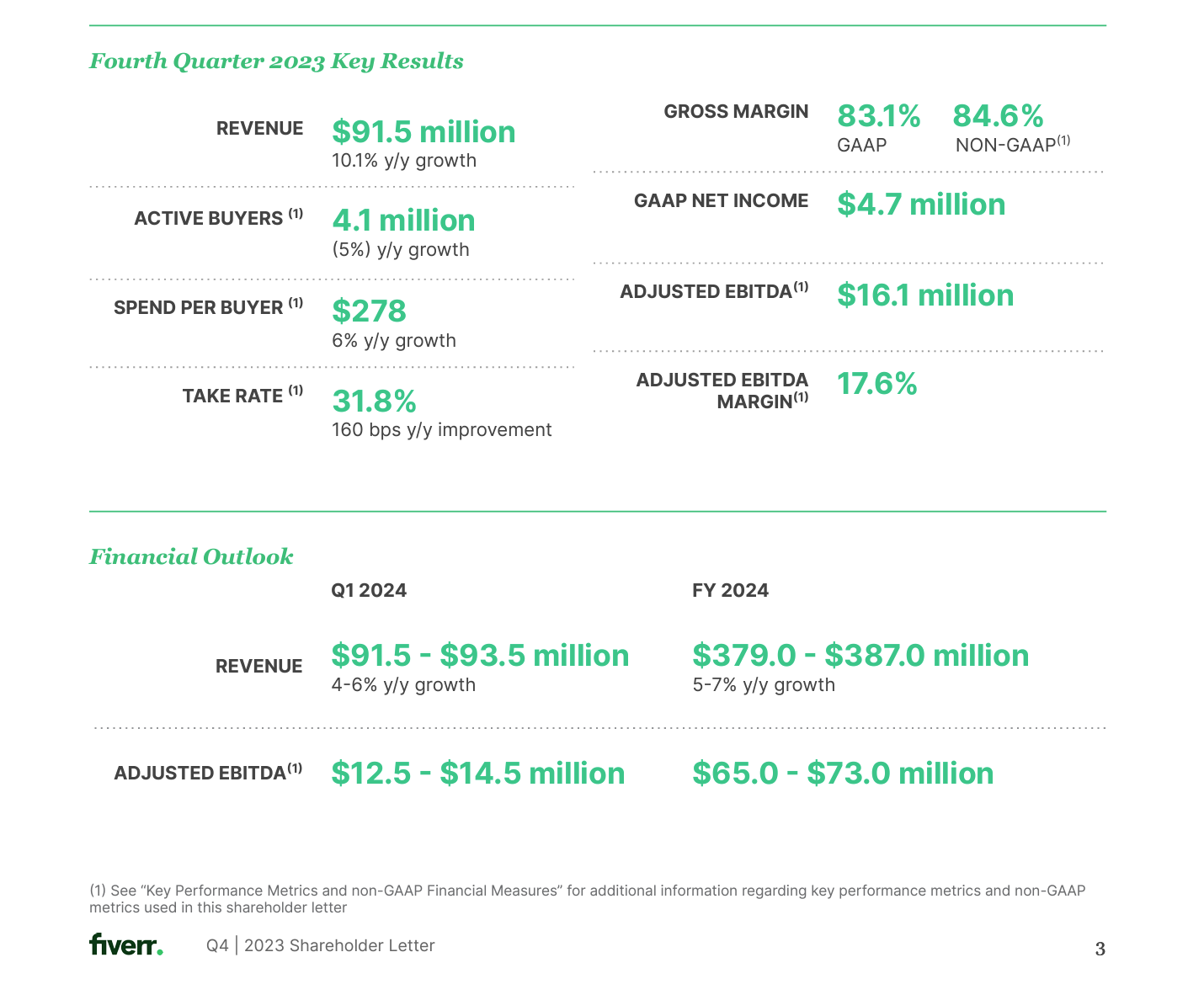

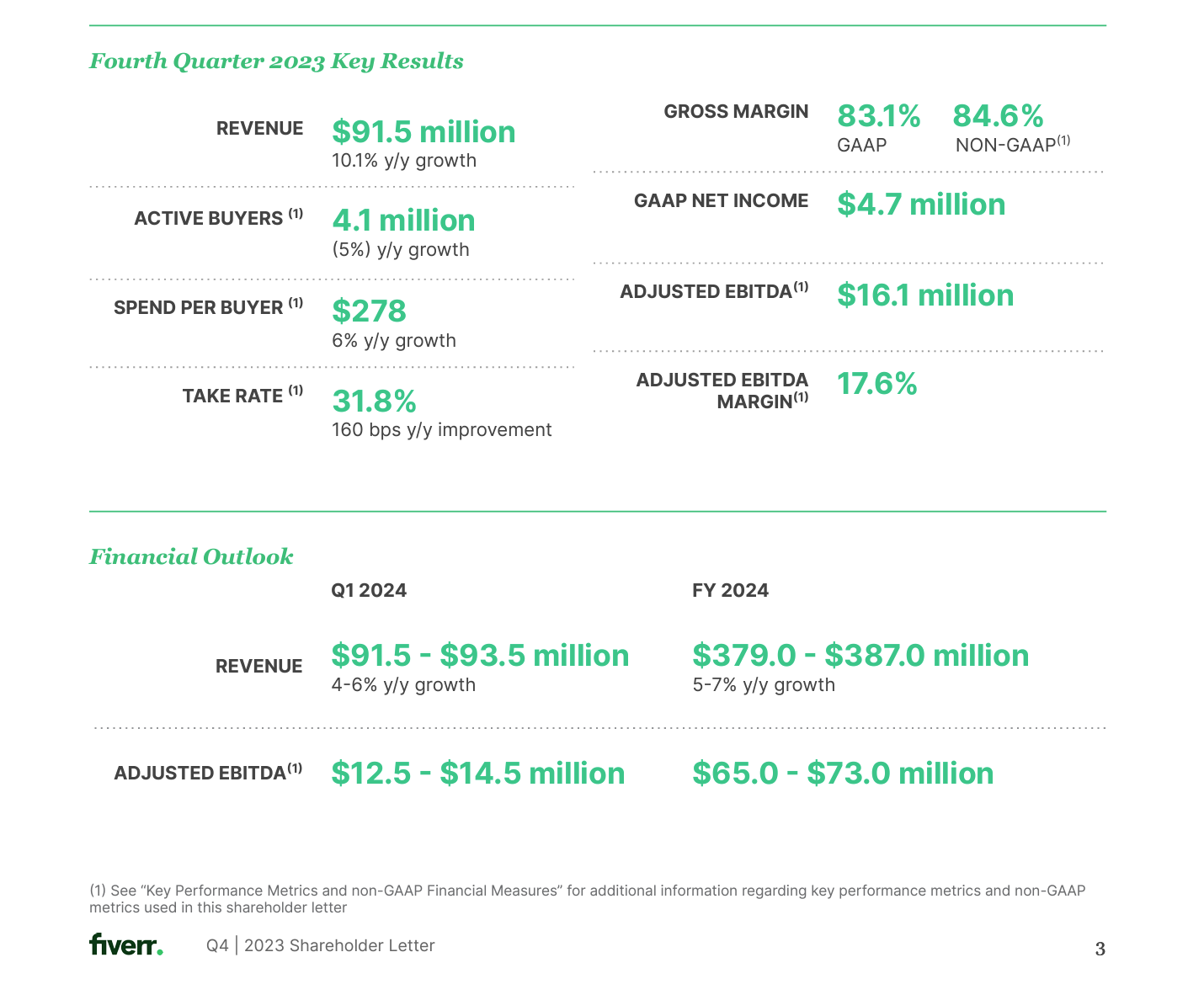

Fourth Quarter 2023 Financial Highlights

- Revenue in the fourth quarter of 2023 was $91.5 million, compared to $83.1 million in the fourth quarter of 2022, an increase of 10.1% year over year.

- Active buyers1 as of December 31, 2023 was 4.1 million, compared to 4.3 million as of December 31, 2022, a decrease of 5% year over year.

- Spend per buyer1 as of December 31, 2023 reached $278, compared to $262 as of December 31, 2022, an increase of 6% year over year.

- Take rate1 for the period ended December 31, 2023 was 31.8%, up from 30.2% for the period ended December 31, 2022, an increase of 160 basis points year over year.

- GAAP gross margin in the fourth quarter of 2023 was 83.1%, an increase of 210 basis points from 81.0% in the fourth quarter of 2022. Non-GAAP gross margin1 in the fourth quarter of 2023 was 84.6%, an increase of 150 basis points from 83.1% in the fourth quarter of 2022.

- GAAP net income in the fourth quarter of 2023 was $4.7 million, or $0.12 basic and diluted net income per share, compared to ($1.3) million net loss, or ($0.03) basic and diluted net loss per share, in the fourth quarter of 2022.

- Non-GAAP net income1 in the fourth quarter of 2023 was $23.1 million, or $0.6 basic non-GAAP net income per share1 and $0.56 diluted non-GAAP net income per share1, compared to $10.7 million non-GAAP net income, or $0.29 basic non-GAAP net income per share1 and $0.26 diluted non-GAAP net income per share1, in the fourth quarter of 2022.

- Adjusted EBITDA1 in the fourth quarter of 2023 was $16.1 million, compared to $9.4 million in the fourth quarter of 2022. Adjusted EBITDA margin1 was 17.6% in the fourth quarter of 2023, compared to 11.3% in the fourth quarter of 2022.

Full Year 2023 Financial Highlights

Full Year 2023 Financial Highlights

- Revenue in 2023 was $361.4 million, an increase of 7.1% year over year.

- GAAP gross margin in 2023 was 82.9%, an increase of 240 basis points from 80.5% in 2022. Non-GAAP gross margin1 in 2023 was 84.5%, an increase of 150 basis points from 83.0% in 2022.

- GAAP net income in 2023 was $3.7 million, or $0.10 basic net income per share and $0.09 diluted net income per share1, compared to a net loss of ($71.5) million, or ($1.94) basic and diluted net loss per share, in 2022. Non-GAAP net income1 in 2023 was $80.4 million, or $2.11 basic Non-GAAP net income per share1 and $1.95 diluted Non-GAAP net income per share1, compared to $28.9 million, or $0.78 basic Non-GAAP net income per share1 and $0.71 diluted Non-GAAP net income per share1, in 2022.

- Adjusted EBITDA1 in 2023 was $59.2 million, compared to $24.4 million in 2022. Adjusted EBITDA margin1 was 16.4% in 2023, an increase of 920 basis points from 7.2% in 2022.

Financial Outlook

Below we provide our management guidance for the first quarter and full year of 2024, reflecting the recent trends on our marketplace.

Unpacking the underlying drivers, we expect to accelerate our GMV growth by 1%-2% as we continue to invest in progressing upmarket and complex services. Take rate is expected to expand at a more moderate pace in 2024 compared to 2023. Spend per buyer is also expected to accelerate in terms of y/y growth rate, and active buyers to continue to maintain similar trends as in 2023.

For Adjusted EBITDA, we expect to expand our Adjusted EBITDA margin at a steady pace and continue to make progress towards our long-term target of 25%. Overall, we expect to take a balanced and measured approach in driving profitable growth in 2024.

Conference Call and Webcast Details

Fiverr’s management will host a conference call to discuss its financial results on Thursday, February 22, 2024, at 8:30 a.m. Eastern Time. A live webcast of the call can be accessed from Fiverr’s

Investor Relations website. An archived version will be available on the website after the call. To participate in the Conference Call, please register at the link

here.

About Fiverr

Fiverr’s mission is to change how the world works together. We exist to democratize access to talent and to provide talent with access to opportunities so anyone can grow their business, brand, or dreams. From small businesses to Fortune 500, over 4 million customers worldwide worked with freelance talent on Fiverr in the past year, ensuring their workforces remain flexible, adaptive, and agile. With Fiverr Business Solutions, large companies can find the right talent and tools, tailored to their needs to help them thrive and grow. On Fiverr, you can find over 700 skills, ranging from programming to 3D design, digital marketing to content creation, from video animation to architecture.

Don’t get left behind - come be a part of the future of work by visiting

fiverr.com, read our

blog, and follow us on

Twitter, Instagram, and

Facebook.