Fiverr Reports 13% Q4 Revenue Growth, Unveils AI and Freelancer Equity Initiatives

Fiverr delivered an exceptional 2024 performance, closing the year with double-digit revenue growth and a 20% Adjusted EBITDA margin in Q4. Despite a decline in marketplace revenue and active buyers, the company saw significant gains in services revenue (+102% YoY). Key initiatives included the launch of Fiverr Go, a generative AI-powered platform for freelancers, and the Freelancer Equity Program, granting shares to high-performing freelancers. Upmarket expansion through Fiverr Pro subscriptions and Team Accounts further supported revenue growth. Looking ahead, Fiverr projects continued double-digit revenue growth in 2025, focusing on AI innovations and expanding services revenue.

- Delivered an outstanding year of growth and profitability. We finished 2024 on a strong note, with double-digit revenue growth and a 20.0% Adjusted EBITDA margin for Q4’24. Our strong execution of upmarket initiatives such as Fiverr Pro and Dynamic Matching, and our strategy to expand Services revenue as a key growth catalyst, allowed us to deliver results ahead of expectations.

- Introduced an open platform for first-of-its-kind Generative AI solutions for creators and customers: Fiverr Go is a human-centered AI platform that unites businesses, creative talent and AI developers all in one place. It leverages Fiverr’s massive first-party transaction data and creates a revolutionary platform that gives talent full control and pricing power over their AI counterparts.

- Announcing industry-first Freelancer Equity Program: The program is designed to reward high-performing Fiverr freelancers by granting ordinary shares of Fiverr based on their annual earnings growth on the platform. With this initiative, Fiverr is deepening its commitment to independent talent by giving top creators a real stake in our growth. Just as Fiverr Go empowers freelancers to scale like never before, this program ensures they’re not just shaping the future of work - they own a piece of it.

- Going upmarket continues to be a key focus: With the rollout of multi-tier subscription plans of Fiverr Pro, as well as the addition of Team Accounts for freelancers and agencies, we continue to focus on driving upmarket in terms of growing buyers with larger spending capacity as well as enabling larger sellers and more complex projects to transact on the platform.

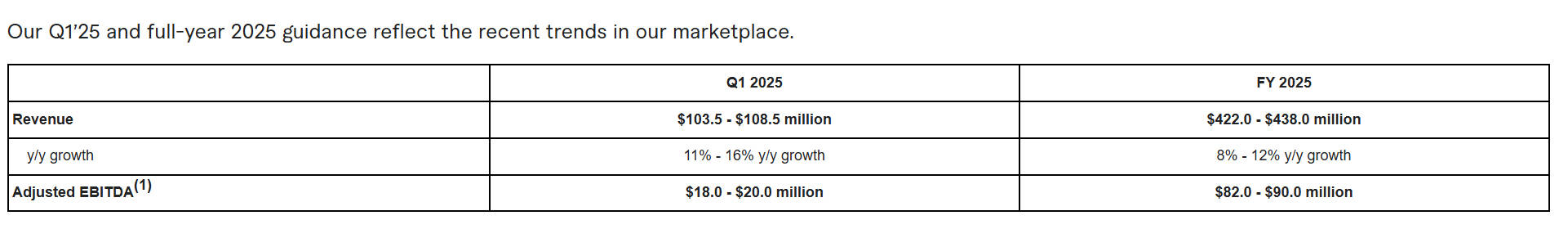

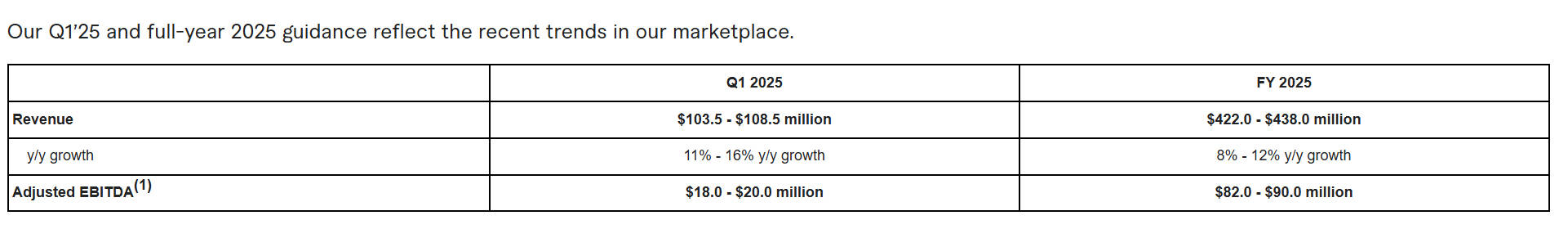

- Strong setup for 2025: Our guidance for 2025 implied double-digit revenue growth at the midpoint and continued steady progress toward our three-year targets laid out in 2024. We believe the strong momentum in Services revenue will serve as a short-term growth catalyst, while our investments in upmarket initiatives and AI will position us for long-term growth opportunities.

NEW YORK, Feb. 19, 2025 -- Fiverr International Ltd. (NYSE: FVRR), the company that is changing how the world works together, today reported financial results for the fourth quarter and full year 2024. Additional operating results and management commentary can be found in the Company’s shareholder letter, which is posted to its investor relations website at

investors.fiverr.com.

“We delivered strong results for 2024, finishing the year well ahead of our initial targets, with double-digit revenue growth and robust margins. We continue to focus on our upmarket initiatives while strategically expanding Services revenue to drive further growth. It has been a year of significant innovation and investment in AI. Our latest launch, the revolutionary and unique human-centered AI platform Fiverr Go, allows our talent community to build their own creation models, control their creative rights, and take their business to the next level,” said Micha Kaufman, founder and CEO of Fiverr. “We started off 2025 with significant momentum in our product pipeline, growth trajectory and investments, giving us confidence in the long-term opportunity ahead.”

"Throughout 2024 we successfully exceeded expectations on both top and bottom lines. Our ability to deliver growth, while showing continued discipline in driving profitability, demonstrates our steady progress towards achieving our Adjusted EBITDA and free cash flow three-year targets” said Ofer Katz, President and CFO of Fiverr. “We will continue to execute a thoughtful capital allocation strategy, balancing the need for growth as well as returning capital to shareholders. The guidance we gave for 2025 reflects our optimism as we expect to maintain momentum in Services revenue, continue upmarket investments, and lead in AI innovation.”

Fourth Quarter 2024 Financial Highlights

- Revenue in the fourth quarter of 2024 was $103.7 million, compared to $91.5 million in the fourth quarter of 2023, an increase of 13.3% year over year.

- Marketplace revenue in the fourth quarter of 2024 was $73.5 million, compared to $76.6 million in the fourth quarter of 2023, representing a decline of 4.0% year over year.

- Annual active buyers1 as of December 31, 2024 was 3.6 million, compared to 4.0 million as of December 31, 2023, a decline of 10% year over year.

- Annual spend per buyer1 as of December 31, 2024 reached $302, compared to $278 as of December 31, 2023, an increase of 9% year over year.

- Marketplace take rate1 for the period ended December 31, 2024 was 27.6%, up from 27.4% for the period ended December 31, 2023, an increase of 20 basis points year over year.

- Services revenue in the fourth quarter of 2024 was $30.2 million, compared to $14.9 million in the fourth quarter of 2023, representing an increase of 102.1% year over year.

- GAAP gross margin in the fourth quarter of 2024 was 80.5%, a decrease of 260 basis points from 83.1% in the fourth quarter of 2023. Non-GAAP gross margin1 in the fourth quarter of 2024 was 84.0%, a decrease of 60 basis points from 84.6% in the fourth quarter of 2023.

- GAAP net income in the fourth quarter of 2024 was $12.8 million, or $0.36 basic net income per share and $0.33 diluted net income per share, compared to $4.7 million net income, or $0.12 basic and diluted net income per share in the fourth quarter of 2023.

- Non-GAAP net income1 in the fourth quarter of 2024 was $24.9 million, or $0.70 basic non-GAAP net income per share1 and $0.64 diluted non-GAAP net income per share1, compared to $23.1 million non-GAAP net income1, or $0.60 basic non-GAAP net income per share1 and $0.56 diluted non-GAAP net income per share1, in the fourth quarter of 2023.

- Net cash provided by operating activities in the fourth quarter of 2024 was $30.0 million, compared to $27.5 million in the fourth quarter of 2023, an increase of 9.0% year over year.

- Free cash flow1 in the fourth quarter of 2024 was $29.6 million, compared to $27.4 million in the fourth quarter of 2023, an increase of 8.1% year over year.

- Adjusted EBITDA1 in the fourth quarter of 2024 was $20.7 million, compared to $16.1 million in the fourth quarter of 2023. Adjusted EBITDA margin1 was 20.0% in the fourth quarter of 2024, compared to 17.6% in the fourth quarter of 2023, representing a 240 basis points improvement year over year.

Full Year 2024 Financial Highlights

- Revenue in 2024 was $391.5 million, compared to $361.4 million in 2023, an increase of 8.3% year over year.

- Marketplace revenue in 2024 was $303.1 million, compared to $307.0 million in 2023, representing a decline of 1.3% year over year.

- Services revenue in 2024 was $88.4 million, compared to $54.4 million in 2023, representing an increase of 62.5% year over year.

- GAAP gross margin in 2024 was 82.0%, a decrease of 90 basis points from 82.9% in 2023. Non-GAAP gross margin1 in 2024 was 84.3%, a decrease of 20 basis points from 84.5% in 2023.

- GAAP net income in 2024 was $18.2 million, or $0.49 basic net income per share and $0.48 diluted net income per share, compared to a net income of $3.7 million, or $0.10 basic net income per share and $0.09 diluted net income per share in 2023.

- Non-GAAP net income1 in 2024 was $95.1 million, or $2.57 basic Non-GAAP net income per share1 and $2.38 diluted Non-GAAP net income per share1, compared to $80.4 million, or $2.11 basic Non-GAAP net income per share1 and $1.95 diluted Non-GAAP net income per share1, in 2023.

- Net cash provided by operating activities in 2024 was $83.1 million. Net cash provided by operating activities, excluding one-time escrow payment for contingent consideration of $12.2 million, was $95.3 million in 2024, compared to $83.2 million in 2023.

- Free cash flow1 in 2024 was $81.7 million. Free cash flow1, excluding one-time escrow payment for contingent consideration of $12.2 million, was $93.9 million in 2024 compared to $82.1 million in 2023, an increase of 14.3% year over year.

- Adjusted EBITDA in 2024 was $74.2 million, compared to $59.2 million in 2023. Adjusted EBITDA margin was 19.0% in 2024, an increase of 260 basis points from 16.4% in 2023.

Financial Outlook

Our Q1’25 and full-year 2025 guidance reflect the recent trends in our marketplace.

About Fiverr

About Fiverr

Fiverr’s mission is to change how the world works together. We exist to democratize access to talent and to provide talent with access to opportunities so anyone can grow their business, brand, or dreams. From small businesses to Fortune 500, around 4 million customers worldwide worked with freelance talent on Fiverr in the past year, ensuring their workforces remain flexible, adaptive, and agile. With Fiverr Business Solutions, large companies can find the right talent and tools tailored to their needs to help them thrive and grow. On Fiverr, you can find over 700 skill categories, ranging from AI to programming and 3D design, digital marketing to content creation, and from video animation to architecture.

Don’t get left behind - come be a part of the future of work by visiting

fiverr.com, reading our

blog, and following us on

Instagram, X, and

Facebook.