Paychex, Inc. Reports Fourth Quarter and Full Year 2024 Results

- Solid Total Revenue Growth and Operating Margin Expansion

- Full Year 2024 Diluted EPS Growth of 9%; Adjusted Diluted EPS(1) Growth of 11%

- Issues Fiscal 2025 Business Outlook

ROCHESTER, N.Y.--(

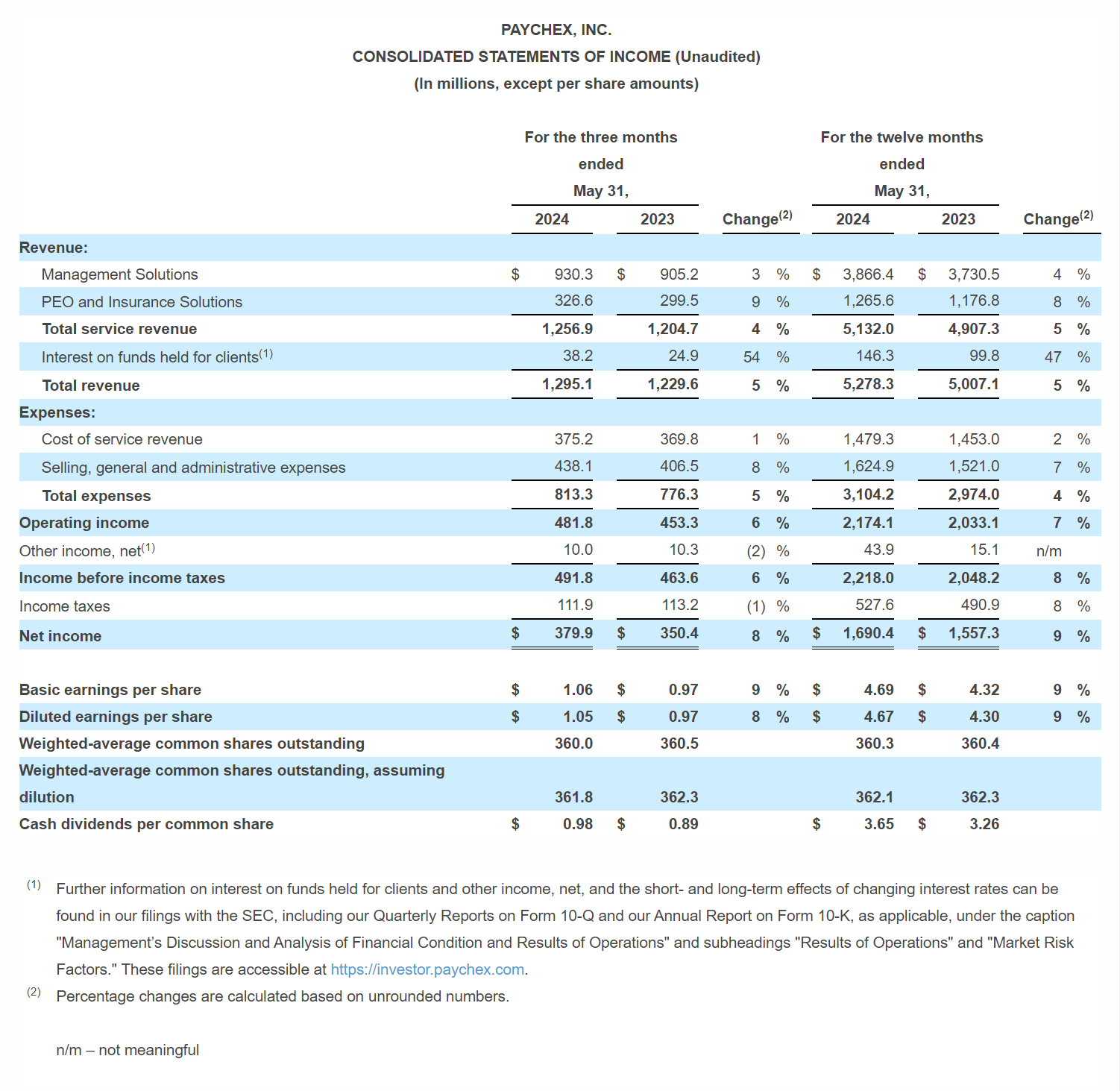

BUSINESS WIRE)--Paychex, Inc. (the "Company," "Paychex," "we," "our," or "us") today announced the following results for the fiscal quarter ended May 31, 2024 (the "fourth quarter") and fiscal year ended May 31, 2024 ("fiscal 2024"), as compared to the corresponding prior-year period:

President and Chief Executive Officer, John Gibson commented, “As we close out the fiscal year, I am pleased to report that Paychex delivered solid financial results, reflecting our ability to navigate changing market conditions by providing innovative HR technology and advisory solutions that deliver value for our clients and their employees and continually finding ways to operate more efficiently as a company. In fiscal 2024, we achieved 5% growth in total revenue, 9% growth in diluted earnings per share and 11% growth in adjusted diluted earnings per share. These results are a testament to the hard work and dedication of our more than 16,000 employees and the investments we have made in our technology and advisory solutions."

Mr. Gibson continued, "Small and mid-size businesses continue to face a challenging operating environment due to complex regulations, a tight labor market and inflationary pressures. Our purpose remains to help these businesses succeed, and we believe we are well positioned to achieve that mission in the upcoming fiscal year.”

Fourth Quarter Business Highlights

Total revenue increased to $1.3 billion for the fourth quarter, growth of 5% over the prior year period, which reflects a lower contribution from our employee retention tax credit ("ERTC") service, impacting growth by approximately 300 basis points. Highlights as compared with the corresponding prior year period are as follows:

Management Solutions revenue increased 3% to $930.3 million for the fourth quarter, primarily impacted by the following factors:

- Continued growth in the number of clients served across our suite of human capital management ("HCM") solutions;

- Higher product penetration, including Human Resource Solutions and Retirement Services; and

- Lower revenue from ancillary services, primarily due to the expiration of our ERTC Service.

Professional Employer Organization ("PEO") and Insurance Solutions revenue increased 9% to $326.6 million for the fourth quarter primarily due to the following:

- Growth in the number of average PEO worksite employees; and

- Increase in PEO insurance revenues.

Interest on funds held for clients increased 54% to $38.2 million for the fourth quarter primarily due to higher average interest rates and invested balances and lower realized losses on investment sales.

Total expenses increased 5% to $813.3 million for the fourth quarter primarily due to the following:

- Cost optimization initiatives totaling $39.5 million, including further reductions to our geographic footprint, reprioritization of certain technology investments and headcount optimization; and

- Increase in PEO direct insurance costs related to growth in average worksite employees and wages, and PEO insurance revenues; offset by

- Lower compensation-related expenses and discretionary spending.

Total expenses, excluding one-time cost optimization initiatives noted above, were relatively flat for the fourth quarter compared to the prior year period.

Operating income grew 6% to $481.8 million for the fourth quarter and adjusted operating income

(1) grew 15% to $521.3 million. Operating margin (operating income as a percentage of total revenue) was 37.2% for the fourth quarter compared to 36.9% for the prior year period. Adjusted operating margin

(1) (operating income, adjusted for one-time items, as a percentage of total revenue) was 40.2% for the fourth quarter compared to 36.9% for the prior year period.

Other income, net remained relatively flat for the fourth quarter compared to the prior year period.

Our effective income tax rate was 22.8% for the fourth quarter and 24.4% for the prior year period. The current year fourth quarter was impacted by the recognition of net discrete tax benefits related to employee stock-based compensation payments.

Diluted earnings per share increased 8% to $1.05 per share and adjusted diluted earnings per share

(1) increased 15% to $1.12 per share for the fourth quarter.

Fiscal Year Business Highlights

Highlights for fiscal 2024 as compared with the corresponding prior year are as follows:

- Total revenue increased 5% to $5.3 billion.

- Operating income increased 7% to $2.2 billion and adjusted operating income(1) increased 9% to $2.2 billion. Operating margin was 41.2% for the fiscal year compared to 40.6% for the prior year. Adjusted operating margin(1) was 41.9% for the fiscal year compared to 40.6% for the prior year.

- Our effective income tax rate was 23.8% for fiscal 2024 compared to 24.0% for the fiscal year ended May 31, 2023. Both periods were impacted by the recognition of net discrete tax benefits related to employee stock-based compensation payments.

- Diluted earnings per share increased 9% to $4.67 per share. Adjusted diluted earnings per share(1) increased 11% to $4.72 per share.

Financial Position and Liquidity

Our financial position and cash flow generation remained strong during fiscal 2024. As of May 31, 2024, we had:

- Cash, restricted cash, and total corporate investments of $1.6 billion.

- Short-term and long-term borrowings, net of debt issuance costs, of $817.3 million.

- Cash flow from operations was $1.9 billion for the fiscal year.

Return to Stockholders During Fiscal 2024

- Paid cumulative dividends of $3.65 per share totaling $1.3 billion, resulting in a dividend payout ratio of 78% of net income.

- Repurchased 1.5 million shares of our common stock for $169.2 million.

In addition to reporting operating income, operating margin, net income and diluted earnings per share, which are U.S. GAAP measures, we present adjusted operating income, adjusted operating margin, adjusted net income, adjusted diluted earnings per share, earnings before interest, taxes, depreciation, and amortization ("EBITDA") and adjusted EBITDA, which are non-GAAP measures. We believe these additional measures are indicators of our core business operations’ performance period over period. Adjusted operating income, adjusted operating margin, adjusted net income, adjusted diluted earnings per share, EBITDA, and adjusted EBITDA are not calculated through the application of U.S. GAAP and are not required forms of disclosure by the Securities and Exchange Commission ("SEC"). As such, they should not be considered a substitute for the U.S. GAAP measures of operating income, net income, and diluted earnings per share, and, therefore, they should not be used in isolation but in conjunction with the U.S. GAAP measures. The use of any non-GAAP measure may produce results that vary from the U.S. GAAP measure and may not be comparable to a similarly defined non-GAAP measure used by other companies.

Business Outlook

Our business outlook for the fiscal year ending May 31, 2025 ("fiscal 2025") incorporates current assumptions and market conditions. Changes in the macroeconomic environment could alter our guidance. With consideration of these impacts, we have updated our business outlook as follows:

- Total revenue is anticipated to grow in the range of 4.0% to 5.5%.

- Adjusted diluted earnings per share(1) is anticipated to grow in the range of 5% to 7%.

- Management Solutions revenue is anticipated to grow in the range of 3.0% to 4.0%.

- PEO and Insurance Solutions revenue is anticipated to grow in the range of 7.0% to 9.0%.

- Interest on funds held for clients is expected to be in the range of $150 million to $160 million.

- Operating margin is anticipated to be in the range of 42% to 43%.

- Other income, net is anticipated to be in the range of $35 million to $40 million.

- The effective income tax rate for fiscal 2025 is anticipated to be in the range of 24% to 25%.

Environmental, Social, and Governance ("

ESG"

)

As part of what it means to be Paychex, we are focusing our ESG efforts on actions we can take to create positive impact. To learn more about our latest initiatives, please visit

https://www.paychex.com/corporate/corporate-responsibility. The information available on our website is not a part of, and is not incorporated into, this press release.

Annual Report on Form 10-K ("Form 10-K")

We anticipate filing our Form 10-K before the end of July 2024, and it will be available at

https://investor.paychex.com. This press release should be read in conjunction with the Form 10-K and the related Notes to Consolidated Financial Statements and Management's Discussion and Analysis of Financial Condition and Results of Operations contained in that Form 10-K.

Webcast Details

Interested parties may access the webcast of our Earnings Release Conference Call, scheduled for June 26, 2024, at 9:30 a.m. Eastern Time, at

https://investor.paychex.com. The webcast will be archived for approximately 90 days. Our news releases, current financial information, SEC filings, and investor presentations are also accessible at

https://investor.paychex.com.

About Paychex

Paychex, Inc. (Nasdaq: PAYX) is an industry-leading HCM company delivering a full suite of technology and advisory services in human resources, employee benefit solutions, insurance, and payroll. The company serves over 745,000 customers in the U.S. and Europe and pays one out of every 12 American private sector employees. The more than 16,000 people at Paychex are committed to helping businesses succeed and building thriving communities where they work and live. To learn more, visit

www.paychex.com.

Cautionary Note Regarding Forward-Looking Statements

Certain written and oral statements made by us may constitute "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by such words and phrases as "expect," "outlook," "will," guidance," "projections," "anticipate," "believe," "could," "may," "possible," "potential" and other similar words or phrases. Examples of forward-looking statements include, among others, statements we make regarding operating performance, events, or developments that we expect or anticipate will occur in the future, including statements relating to our outlook, revenue growth, earnings, earnings-per-share growth, or similar projections.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations, and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict, many of which are outside our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not place undue reliance upon any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

- our ability to keep pace with changes in technology or provide timely enhancements to our solutions and support;

- software defects, undetected errors, and development delays for our solutions;

- the possibility of cyberattacks, security vulnerabilities or Internet disruptions, including data security and privacy leaks, and data loss and business interruptions;

- the possibility of failure of our business continuity plan during a catastrophic event;

- the failure of third-party service providers to perform their functions;

- the possibility that we may be exposed to additional risks related to our co-employment relationship with our PEO business;

- changes in health insurance and workers’ compensation insurance rates and underlying claim trends;

- risks related to acquisitions and the integration of the businesses we acquire;

- our clients’ failure to reimburse us for payments made by us on their behalf;

- the effect of changes in government regulations mandating the amount of tax withheld or the timing of remittances;

- our failure to comply with covenants in our debt agreements;

- changes in governmental regulations, laws, and policies;

- our ability to comply with U.S. and foreign laws and regulations;

- our compliance with data privacy and artificial intelligence laws and regulations;

- our failure to protect our intellectual property rights;

- potential outcomes related to pending or future litigation matters;

- the impact of macroeconomic factors on the U.S. and global economy, and in particular on our small- and medium-sized business clients;

- volatility in the political and economic environment, including inflation and interest rate changes;

- changes in the availability and retention of qualified people; and

- the possible effects of negative publicity on our reputation and the value of our brand.

Any of these factors, as well as such other factors as discussed in our SEC filings, could cause our actual results to differ materially from our anticipated results. The information provided in this document is based upon the facts and circumstances known as of the date of this press release, and any forward-looking statements made by us in this document speak only as of the date on which they are made. Except as required by law, we undertake no obligation to update these forward-looking statements after the date of issuance of this press release to reflect events or circumstances after such date, or to reflect the occurrence of unanticipated events.