Payoneer Expands Global Footprint with Strategic Acquisition of Skuad for $61 Million

Payoneer, a global leader in cross-border payment solutions, has announced its acquisition of Singapore-based HR and payroll startup Skuad for $61 million. This strategic move is aimed at strengthening Payoneer's position in the global fintech market, particularly in the rapidly expanding small and medium-sized business (SMB) sector. Skuad, founded in 2019, specializes in simplifying international hiring and payroll management across over 160 countries. The acquisition could increase to $81 million based on Skuad's future performance, with Payoneer also offering $10 million in restricted stock units to retain key Skuad personnel. The integration of Skuad's technology and expertise is expected to enhance Payoneer's service offerings, positioning it to better support SMBs in their global operations.

New York, August 9, 2024 — In a significant move to enhance its global service offerings,

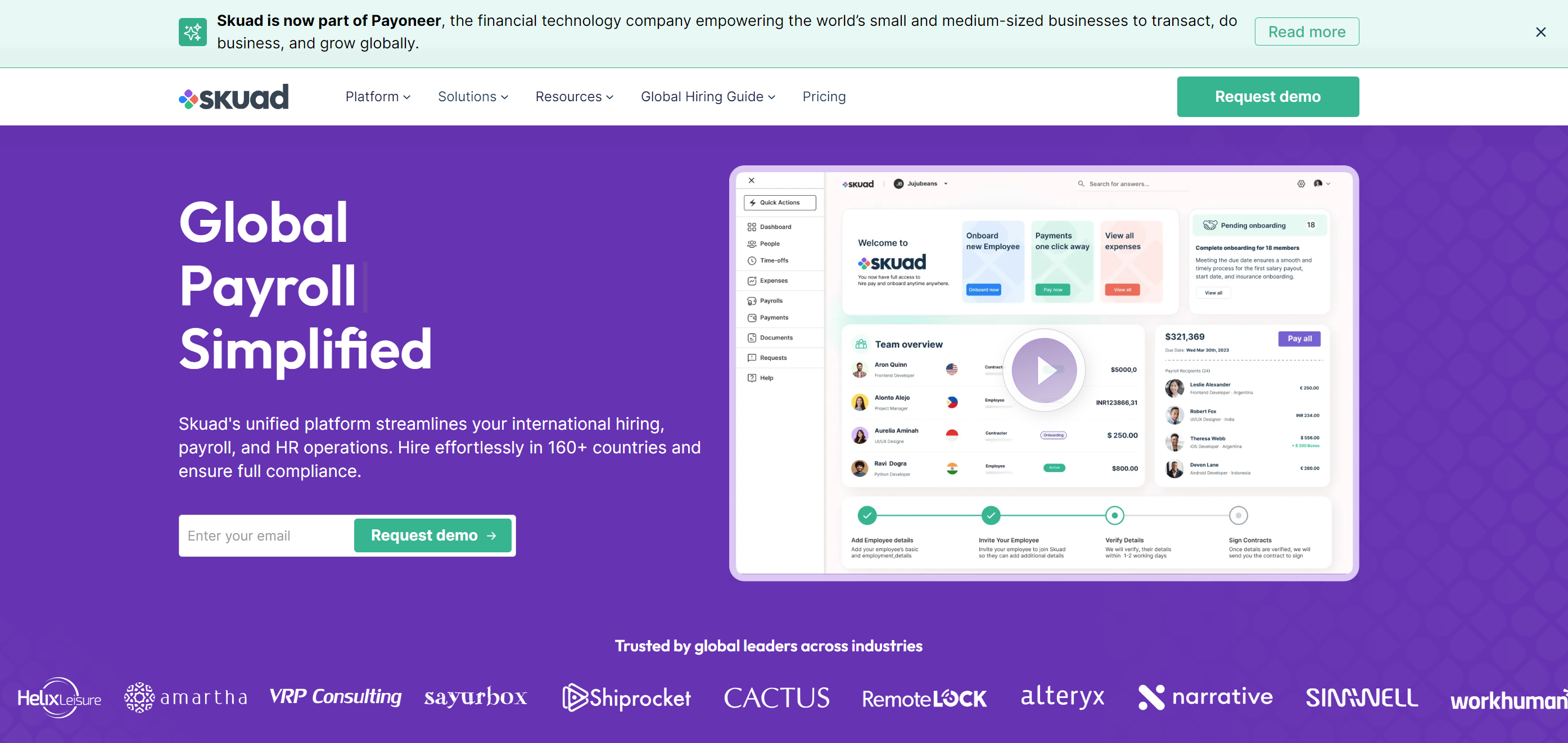

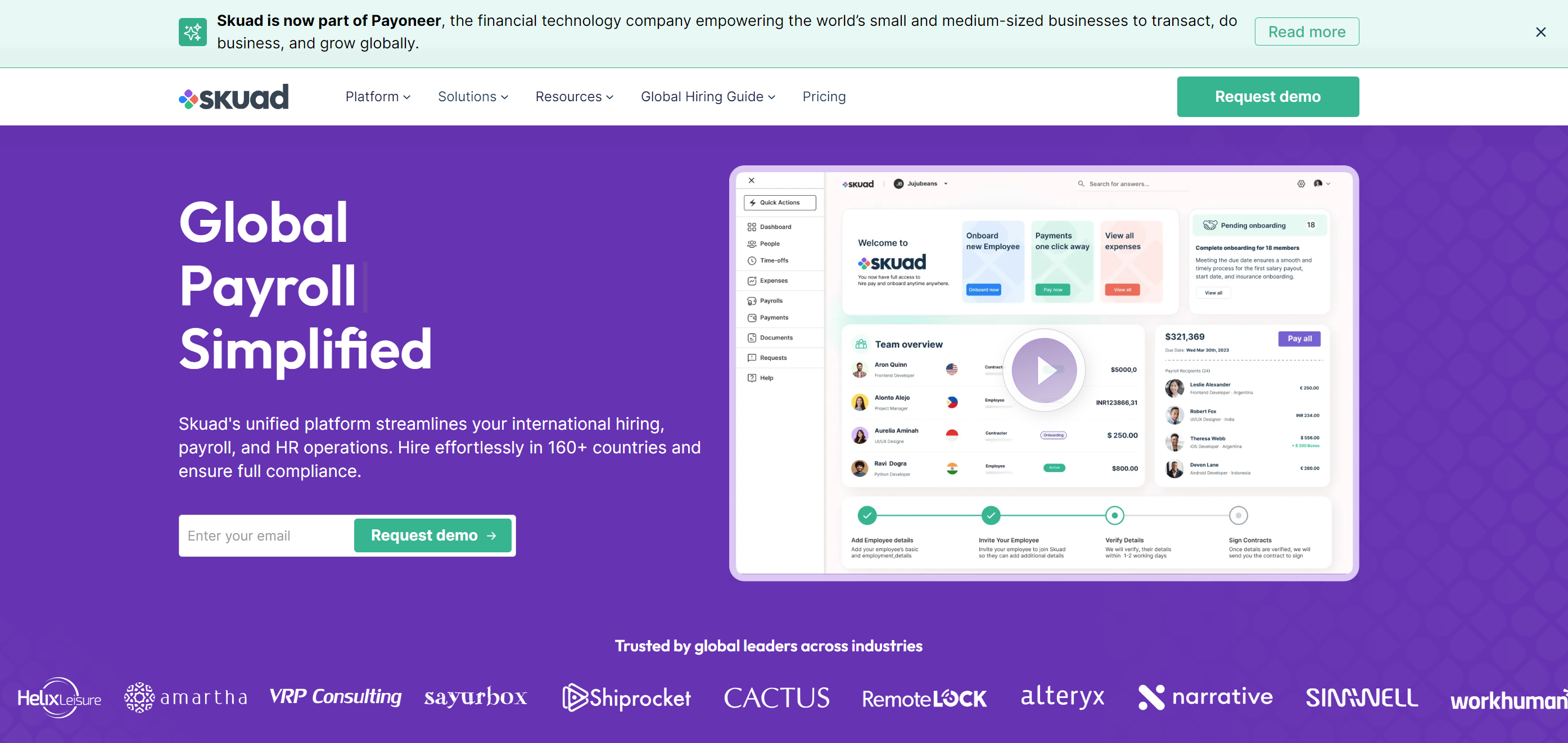

Payoneer, the New York-based fintech giant known for its cross-border payment solutions, has acquired Singapore-based HR and payroll startup

Skuad for $61 million in cash. This acquisition is poised to further strengthen Payoneer’s position in the competitive fintech landscape, particularly within the rapidly expanding global SMB market.

Founded in 2019,

Skuad has quickly emerged as a key player in simplifying international hiring and payroll management for small and medium-sized businesses (SMBs) operating in over 160 countries. The startup’s innovative solutions have addressed the complexities of global recruitment, such as navigating diverse regulatory environments and managing cross-border payrolls, making it an attractive acquisition target for Payoneer.

The total value of the acquisition could rise to approximately $81 million, with Payoneer potentially paying an additional $10 million based on Skuad’s performance over the next 18 months. Moreover, Payoneer has committed to granting $10 million in restricted stock units to key Skuad personnel, contingent on continued employment, ensuring that the talent driving Skuad’s success remains part of the larger Payoneer team.

John Caplan, CEO of Payoneer, highlighted the strategic importance of this acquisition, stating, “One of the biggest opportunities Payoneer is pursuing is capturing share in the $6 trillion B2B market. SMBs around the world are tapping into global opportunities by exporting goods and services across borders. The integration of Skuad’s payroll and contract management solutions will enable us to provide even more comprehensive support to these businesses.”

Skuad’s approximately 200 employees will join Payoneer’s workforce, which currently exceeds 2,150 employees globally. The integration of Skuad’s technology and expertise is expected to complement Payoneer’s existing cross-border payment services, offering SMBs a more seamless and scalable solution for managing their international operations.

This acquisition comes amidst a broader trend of consolidation in the fintech sector, driven in part by a slowdown in venture capital investments. As companies seek to expand their capabilities and market reach, strategic acquisitions like Payoneer’s purchase of Skuad are becoming increasingly common.

Payoneer has been on an acquisition spree in recent years, acquiring AI data startup Spott and a China-licensed payments company in 2023, as well as German payments startup optile in 2019. With the addition of Skuad, Payoneer is well-positioned to further solidify its leadership in the global fintech space, particularly in emerging markets where SMBs are rapidly growing.

As the remote work trend continues to gain momentum in the post-pandemic world, Payoneer’s expanded service offerings are expected to meet the evolving needs of businesses navigating the challenges of international hiring and payroll management, ensuring they remain competitive on the global stage.