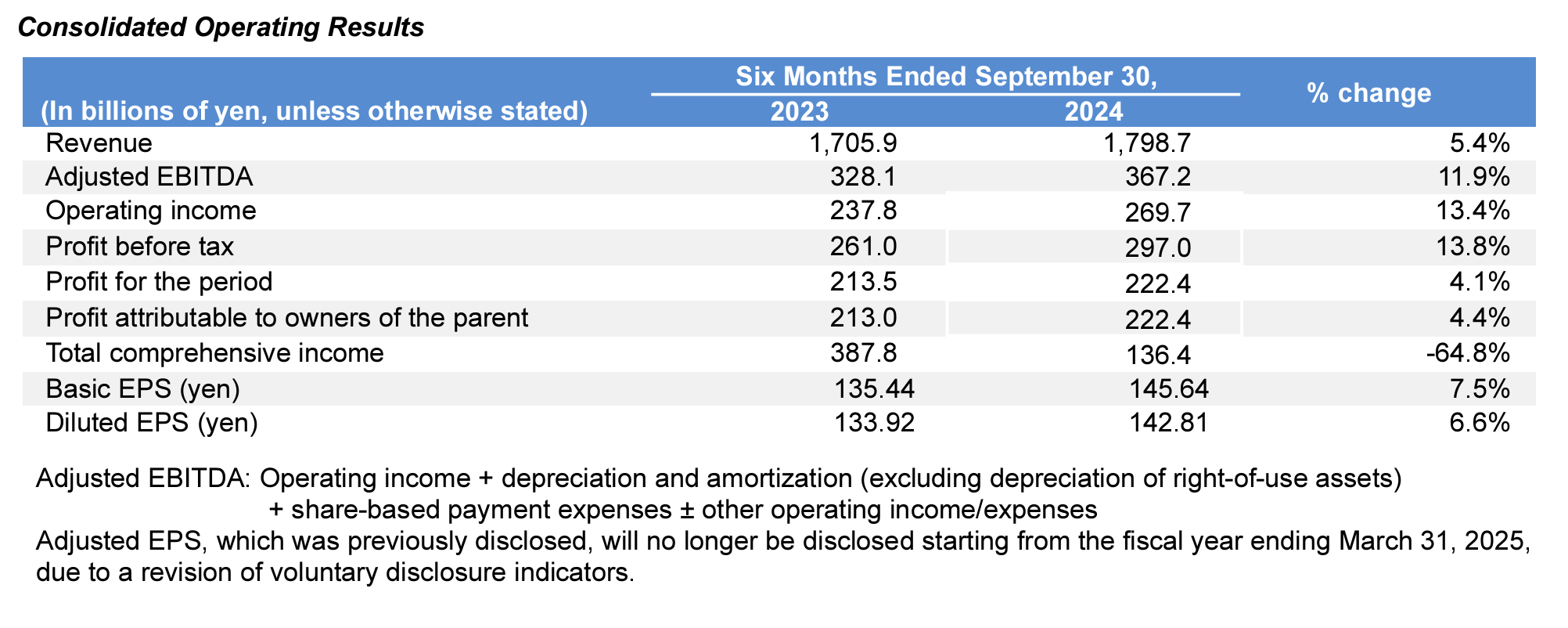

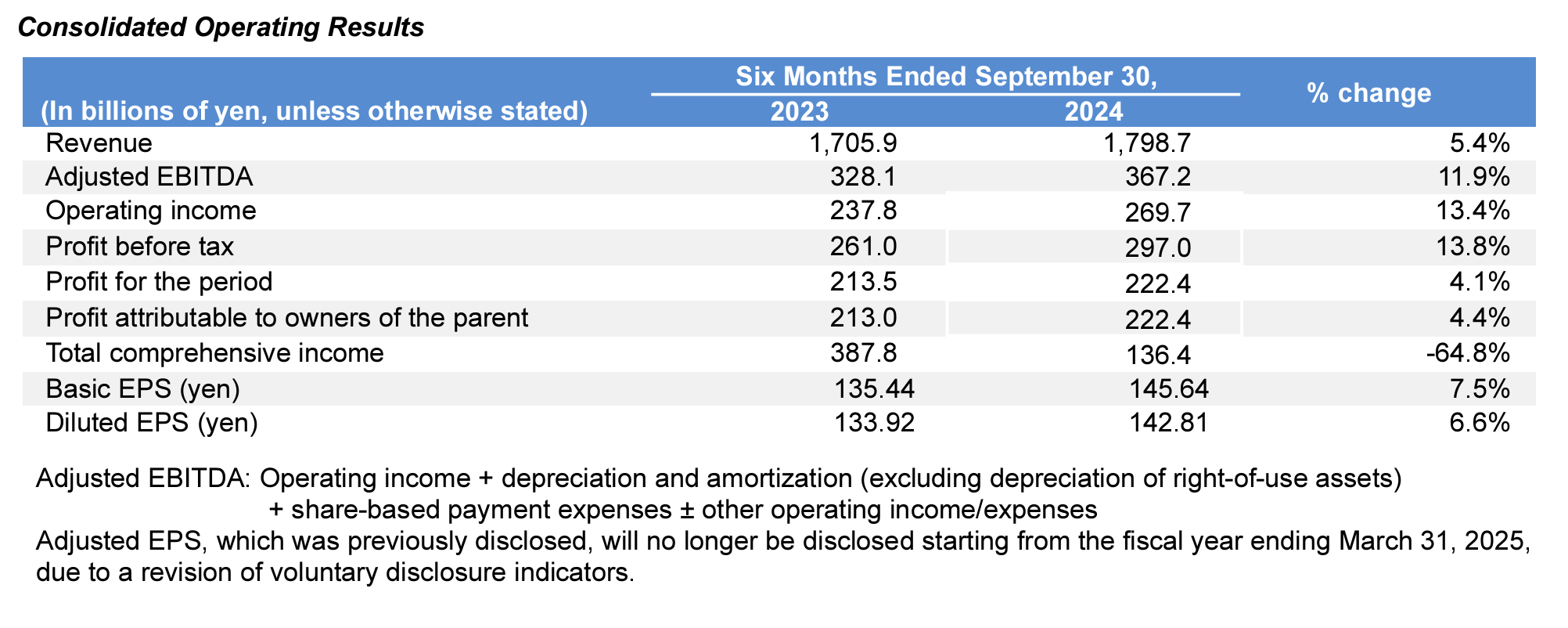

Recruit Holdings Achieves $11.99 Billion Revenue in Q2 FY2024 with 5.4% Growth, Notable Increases in Operating Income and EPS

Recruit Holdings Co., Ltd. reported solid Q2 FY2024 financial results, with revenue reaching ¥1.7987 trillion, a 5.4% year-over-year increase. Adjusted EBITDA grew by 11.9% to ¥367.2 billion, while operating income rose 13.4% to ¥269.7 billion. Profit before tax was ¥297.0 billion, a 13.8% increase from the previous year. The HR Technology segment saw a 10.3% revenue boost, largely driven by a 57.5% increase in Japan. Matching & Solutions grew by 2.1%, thanks to SaaS expansion in Marketing Solutions. Staffing revenue rose by 4.0%, with strong demand in Japan offsetting declines in the U.S. and Europe. The company revised its FY2024 outlook to reflect revenue between ¥3.4687 trillion and ¥3.5487 trillion, indicating steady growth.

Tokyo, Japan, November 11, 2024

Tokyo, Japan, November 11, 2024 — Recruit Holdings Co., Ltd. (TSE: 6098), a global leader in HR technology, announced its Q2 financial results for fiscal year 2024, ending September 30, 2024. The company recorded a consolidated revenue of ¥1.7987 trillion, a 5.4% year-over-year increase, supported by robust growth across its HR Technology, Matching & Solutions, and Staffing segments. Recruit Holdings continues to perform strongly amidst a challenging economic landscape, and in light of its solid results, has updated its full-year financial outlook.

1. Financial Highlights

For the six months ending September 30, 2024, Recruit Holdings achieved consolidated revenue of ¥1.7987 trillion, reflecting a 5.4% increase from the previous year. Adjusted EBITDA grew by 11.9% to ¥367.2 billion, while operating income rose 13.4% to ¥269.7 billion. Profit before tax reached ¥297.0 billion, a 13.8% year-over-year increase, and profit attributable to owners of the parent grew by 4.4% to ¥222.4 billion. Basic earnings per share (EPS) rose 7.5% to ¥145.64.

The company’s overall profitability metrics demonstrated resilience despite fluctuations in the economic environment, reflecting Recruit Holdings' effective cost management and ongoing investments in core business growth.

2. Business Segment Performance

2. Business Segment Performance

Recruit Holdings operates through three primary business segments: HR Technology, Matching & Solutions, and Staffing. Each segment recorded notable achievements in Q2 FY2024:

HR Technology

The HR Technology segment, encompassing operations in the U.S., Japan, and other global markets, reported a revenue increase of 10.3%, reaching ¥568.2 billion. Revenue in the U.S. market grew by 2.4% in dollar terms due to an increase in average revenue per paid job ad, which offset a decline in the volume of paid ads. In Japan, the segment experienced significant growth of 57.5% year-over-year, supported by the integration of job ad revenue from the Matching & Solutions segment into Indeed Japan. Revenue from the rest of the world also rose by 3.5%.

Adjusted EBITDA for HR Technology was ¥207.3 billion, with an improved EBITDA margin of 36.5%, up by 2 percentage points from the previous year. The margin expansion was largely attributed to reduced employee benefit expenses following a headcount optimization effort in May. The segment has demonstrated effective adaptability to the easing supply-demand mismatch in the U.S. job market, alongside successful revenue generation initiatives in Japan.

Matching & Solutions

The Matching & Solutions segment comprises HR Solutions and Marketing Solutions. The segment recorded total revenue of ¥408.5 billion, a 2.1% year-over-year increase. HR Solutions saw a revenue decline due to the continued shift of job ad revenue to the HR Technology segment, but Marketing Solutions achieved a notable revenue growth of 8.0%. Growth was led by increased sales in the Beauty, Travel, and Dining segments and the adoption of SaaS solutions from Air BusinessTools. Additionally, Housing & Real Estate showed steady gains.

The segment’s adjusted EBITDA reached ¥108.0 billion, a 21.7% increase, and its EBITDA margin rose to 26.4% from 22.2% in the previous year. The strong performance in Marketing Solutions, combined with cost controls focused on service outsourcing expenses, contributed to this result. Air BusinessTools, a SaaS solution supporting operational efficiency, reached 4.05 million registered accounts by the end of Q2, representing a 16.7% increase from the previous year and underscoring its impact on Marketing Solutions growth.

Staffing

The Staffing segment serves markets in Japan, Europe, the U.S., and Australia, delivering temporary and contract staffing solutions. Revenue for the segment totaled ¥840.3 billion, a 4.0% increase year-over-year. In Japan, revenue rose by 7.2%, driven by continued demand for temporary staffing services. Conversely, revenue in Europe, the U.S., and Australia declined by 0.9% due to softened demand in an uncertain economic environment.

Adjusted for currency effects, revenue in the U.S. and Europe was down 5.2%. Despite these challenges, adjusted EBITDA for the segment grew to ¥55.4 billion, up 6.4%, with a modest margin increase to 6.6%. Japan’s robust staffing demand and favorable currency effects helped offset the impacts of weaker demand in the U.S. and Europe.

3. Capital Management and Shareholder Returns

In line with its capital allocation strategy, Recruit Holdings conducted significant share repurchases in FY2024. The company’s board authorized a share repurchase program of up to ¥600 billion in July 2024. As of October 31, Recruit Holdings had repurchased 52.8 million shares for a total of ¥474.9 billion, including purchases through Tokyo Stock Exchange and ToSTNeT-3 transactions. The repurchase program aligns with Recruit Holdings’ goal to optimize capital structure and enhance shareholder value amid prevailing market conditions.

Furthermore, Recruit Holdings has access to an unused ¥113 billion overdraft facility and a committed credit line of ¥200 billion, in addition to a registered ¥200 billion bond issuance program in Japan. These facilities provide additional financial flexibility to support growth initiatives and strategic investments.

4. FY2024 Full-Year Outlook

Based on its performance in the first half and current market conditions, Recruit Holdings has updated its FY2024 outlook. The company now forecasts full-year revenue in the range of ¥3.4687 trillion to ¥3.5487 trillion, representing a year-over-year growth of 1.5% to 3.9%. Adjusted EBITDA is projected to be between ¥622.2 billion and ¥682.2 billion, with profit attributable to owners of the parent anticipated at ¥362.4 billion to ¥407.4 billion, marking an increase of 2.5% to 15.2%.

Looking forward, the HR Technology segment will continue enhancing the integration of Indeed and HR Solutions, particularly in Japan. The Matching & Solutions segment will focus on expanding its Marketing Solutions footprint, with a strong emphasis on the Beauty, Travel, and Real Estate sectors. Meanwhile, the Staffing segment aims to leverage Japan’s growing demand while navigating a cautious approach in Europe and the U.S.

Conclusion

Recruit Holdings’ performance in the first half of FY2024 demonstrates the company’s resilience and adaptability across its diverse business portfolio. Through disciplined cost management, strategic share repurchases, and expansion of SaaS solutions, Recruit Holdings has positioned itself for sustainable growth. As the global HR technology landscape evolves, the company’s strategic initiatives and robust financial position provide a solid foundation for future progress, delivering sustained value for shareholders and clients alike.