Revolutionizing Global Equity Management: Slice Secures $7M in Seed Funding to Expand AI-Driven Compliance Platform

Startup

Slice Global Ltd., specializing in global equity management, has raised $7M in seed funding to enhance its AI-driven compliance platform. The round was led by TLV Partners, with contributions from various investors and law firms. Slice addresses the challenges companies face when issuing equity to international employees, navigating different tax laws and regulations. Its platform uses generative AI to ensure continuous compliance and tax optimization. Co-founded by top tech attorney Maor Levran, data scientist Aviram Berg, and AI expert Yoel Amir, Slice aims to simplify global equity management and avoid noncompliance fines. The platform currently supports 23 countries and plans to expand to over 100 by year's end.

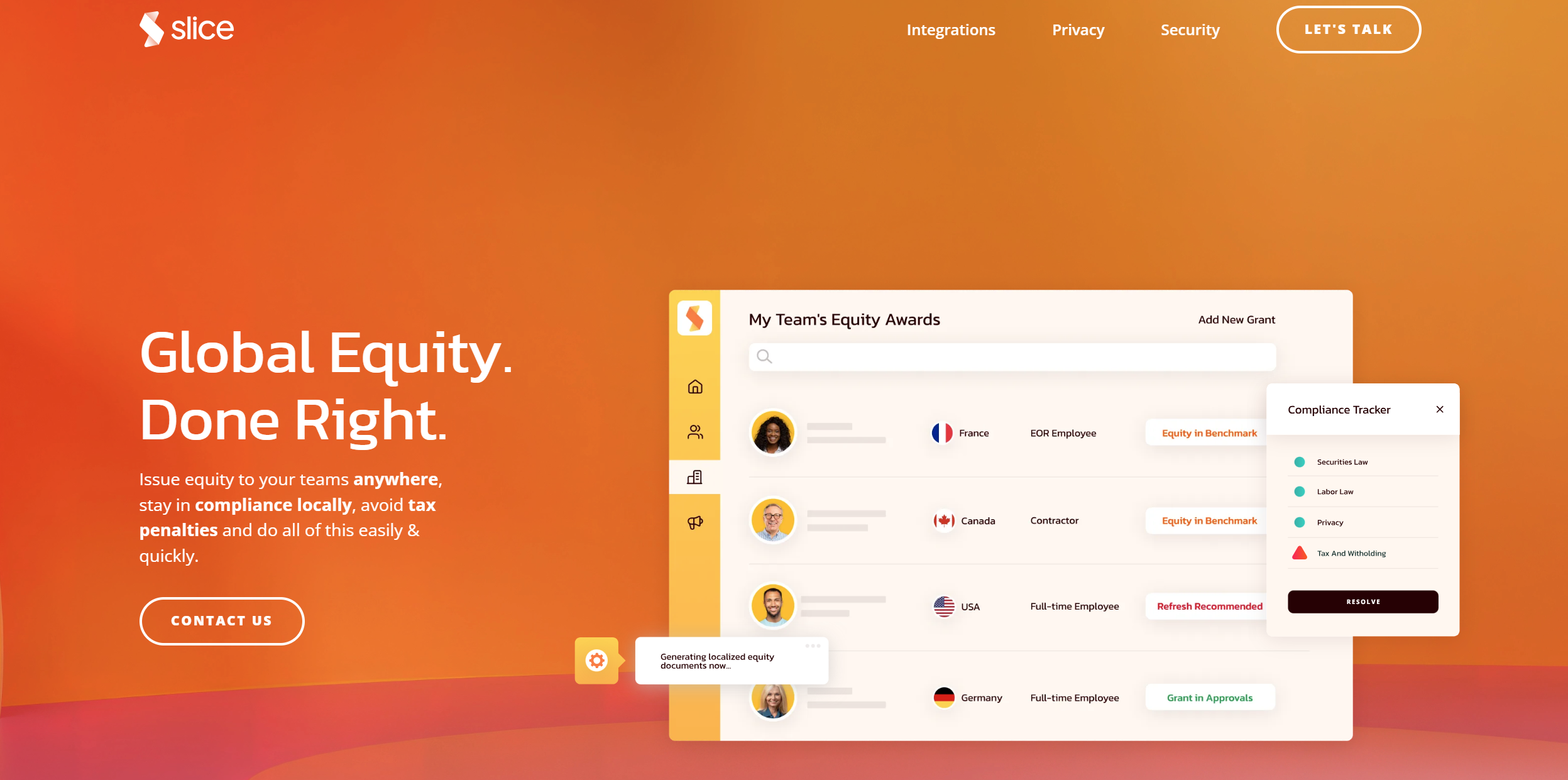

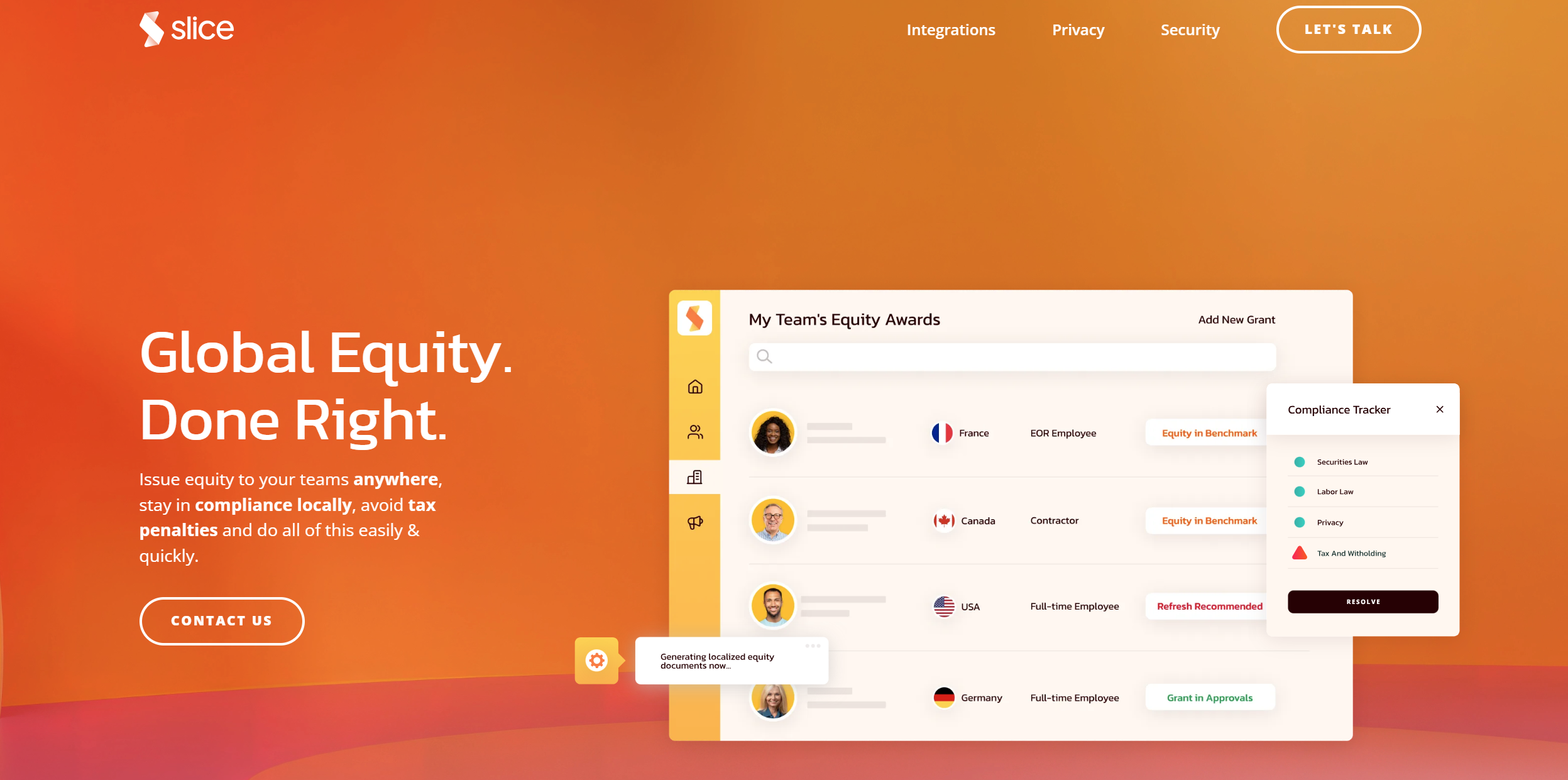

In a significant move towards simplifying global equity management,

Slice a pioneering startup leveraging generative artificial intelligence, has successfully closed a $7 million seed funding round. The round was led by TLV Partners, accompanied by contributions from R-Squared Ventures, Jibe Ventures, and notable international law firms Wilson Sonsini Goodrich & Rosati LLP and Fenwick & West LLP, alongside a group of unnamed angel investors.

Founded with the mission to streamline the complex landscape of global equity compliance, Slice has emerged as a beacon for companies grappling with the intricate web of varying tax laws and regulations across different jurisdictions. The startup's innovative platform utilizes the latest in AI technology to provide a comprehensive solution for managing equity in a compliant and tax-optimized manner, catering to the pressing needs of today's global job market.

As companies increasingly turn to equity as a means to reward and retain top talent internationally, the challenge of adhering to diverse and ever-changing legal requirements has become more pronounced. Slice's platform, by harnessing the power of generative AI, ensures that all global equity operations are fully compliant with local tax codes and regulations, thereby mitigating the risk of financial penalties and legal entanglements.

The company's leadership team brings to the table a wealth of expertise and experience. CEO Maor Levran, recognized as the world's Top Tech Attorney by The Legal 500, co-founder and CTO Aviram Berg, a seasoned data scientist and engineer, and CPO Yoel Amir, an AI product management executive with stints at Salesforce Inc. and Google LLC, collectively provide the strategic vision and technical prowess driving Slice's success.

Slice's utilization of large language models represents a pioneering approach to equity compliance, setting a new industry standard. The platform actively monitors, analyzes, and implements regulatory changes in real-time, covering a wide array of employee stock options and ensuring seamless compliance across 23 countries, with plans for rapid expansion.

The fresh capital infusion will enable Slice to further refine its platform, extend its reach into new legal jurisdictions, and bolster its go-to-market strategies in both the United States and Europe. As the company sets its sights on scaling to over 100 countries by the end of the year, the global landscape of equity management stands on the brink of a transformative shift, heralded by Slice's innovative solutions and ambitious vision.

This funding round not only validates the pressing need for streamlined equity management solutions but also underscores the growing recognition of AI's potential to revolutionize complex regulatory landscapes. As Slice continues to expand its global footprint, the startup is well-positioned to redefine the standards of equity compliance, making it an essential tool for any forward-thinking company operating on the international stage.