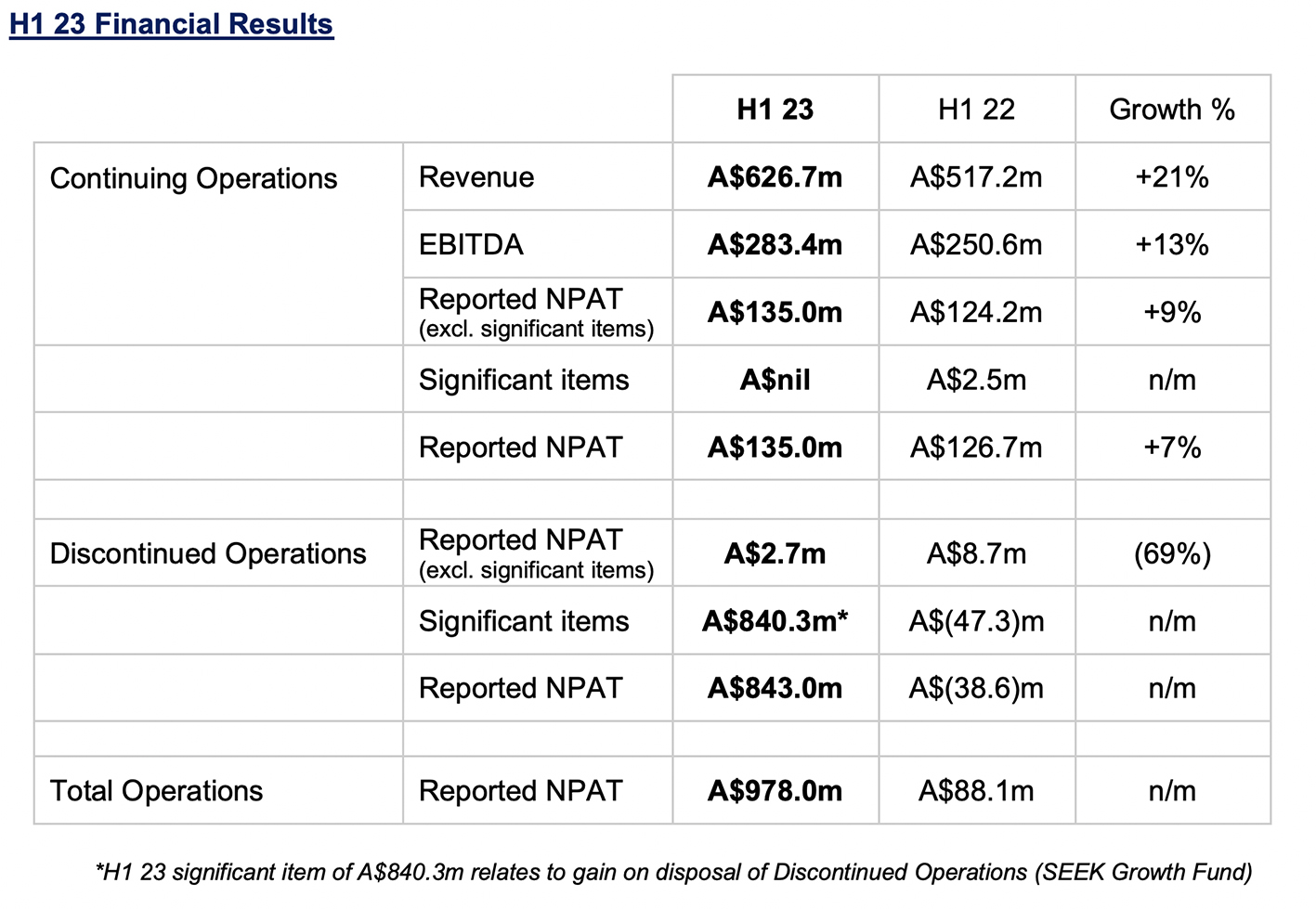

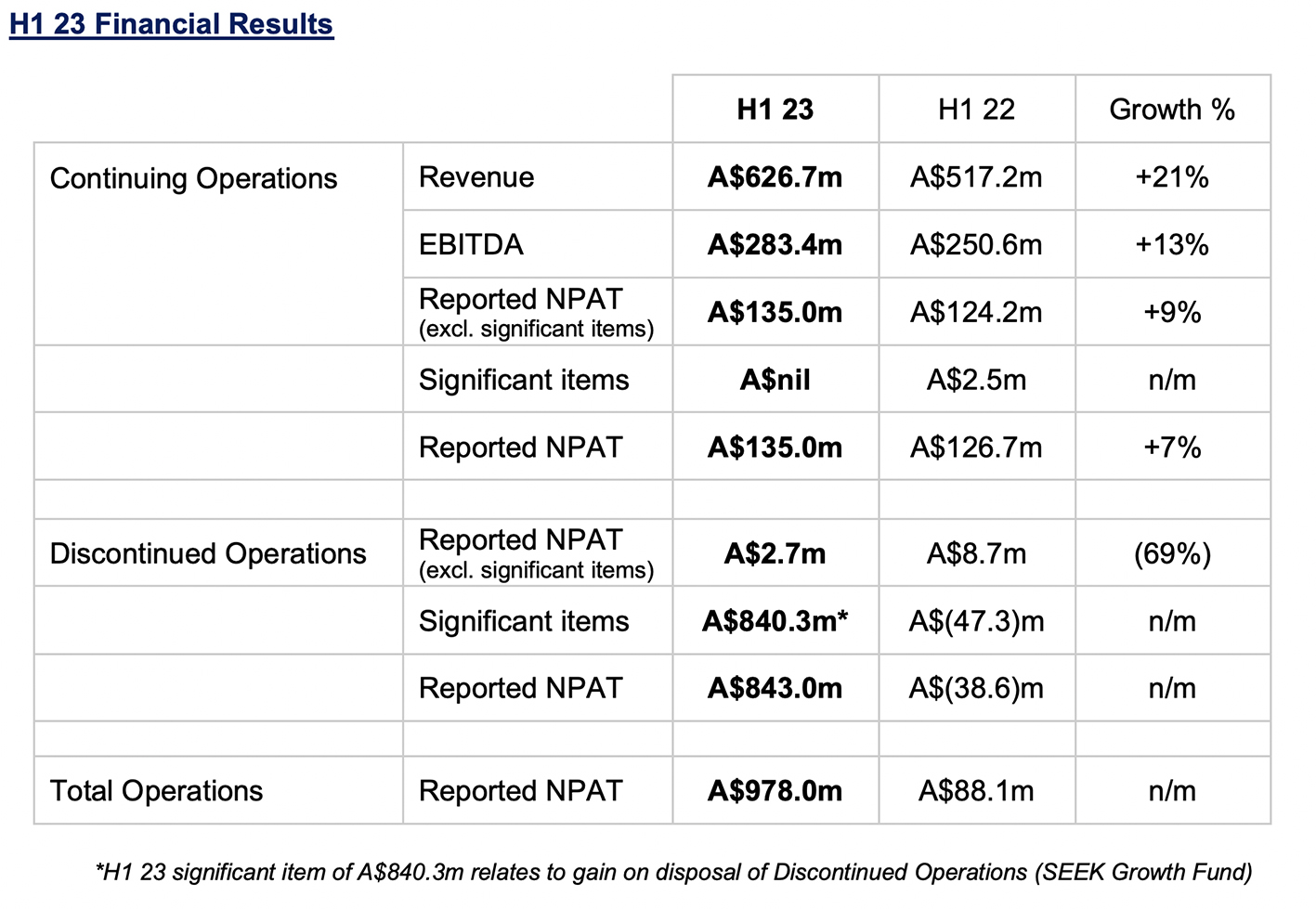

Seek Announces Fiscal Year 2023 Half Year Results, Revenue up 21% Year over Year to Au$626.7 Million

Feb. 21, 2023 --

SEEK, a market leader in online employment marketplaces that span ten countries across Asia Pacific and Latin America, announced half year financial results for the fiscal year 2023.

Highlights

- Half year revenue rose 21% year over year to Au$626.7 million

- Volume growth in SEEK ANZ and to a lesser extent SEEK Asia

- Growth in yield, strongest in SEEK Asia

- Market and brand metrics maintained across ANZ and Asia

- Platform Unification remains on track for completion by the end of FY24

- Increase of 38% in value of investment in the SEEK Growth Fund since inception

- Deconsolidation of SEEK Growth Fund in December 2022

FY23 guidance (excluding significant items) for SEEK’s Continuing Operations

- Revenue of approximately A$1.26bn

- EBITDA of approximately A$560m

- NPAT of approximately A$250m

For the six months ended 31 December, Seek reported a 21% increase in revenue to $626.7 million and a 9% lift in net profit after tax excluding significant items to $135 million.

Including significant items, Seek’s profit came in at $978 million. This includes a one-off gain of $840 million, reflecting the difference between the company’s share of fair value of the SEEK Growth Fund and the carrying value of the assets.

Outside this, Seek’s growth was driven by a 19% increase in ANZ revenue and an 8% lift in ANZ EBITDA, as well as a 25% jump in Seek Asia revenue and a 78% lift in Seek Asia EBITDA.

SEEK CEO and Managing Director Ian Narev comment on the EMPLOYMENT MARKETPLACES:

"Across our Asia Pacific markets, demand for labour remained high during H1 23 which led to increased job ad volumes. In the second quarter, volumes reduced moderately across all markets, and had the usual seasonal variation. Yield increased through adoption of depth products, particularly in Asian markets. SEEK maintained its market leadership positions with stable placement metrics and brand awareness, with JobStreet and JobsDB showing the benefit of last year’s increased marketing investment.

Across ANZ, volumes were higher than in the corresponding half last year, but lower than the peaks we saw in H2 22. Yield increased through higher depth adoption and increased variable ad prices. Our dynamic pricing structure is providing the ability to respond to changes in the marketplace and better align price to value."

Seek also has updated its guidance for FY 2023. And while it expects to achieve its previous guidance, it will now be at the very bottom of its guidance range.

Management advised that it now expects revenue of $1.26 billion compared to previous guidance of $1.25 billion to $1.3 billion.

As for earnings, it is forecasting EBITDA of $560 million and net profit after tax of $250 million. This compares to previous guidance of $560 million to $590 million and $250 million to $270 million, respectively.

Narev concluded: "We are all aware of the potential for ongoing volatility in economic conditions across all our markets. As flagged at the November AGM, we are seeing a gradual moderation in key labour market indicators and our job ad volumes. Our guidance for revenue for the remainder of this financial year remains within the range we provided in August, albeit towards the lower end of that range. Our EBITDA guidance assumes no change to our investment plans for the remainder of the year, including Platform Unification."

For more information, please visit

this post.