Upwork’s Q3 2024 Financial Results: $193.8M Revenue, Record Net Income of $27.8M, and 22% Adjusted EBITDA Margin

Upwork reported strong financial performance in Q3 2024, achieving a 10% year-over-year revenue increase, with GAAP net income reaching a record $27.8 million and adjusted EBITDA at $43.2 million. The company raised its full-year guidance and expanded its AI offerings with enhancements to Uma™, Upwork's Mindful AI. A new $100 million share repurchase program was introduced, underscoring confidence in continued growth. Upwork announced a definitive agreement to acquire Objective AI to boost its AI-driven search and match capabilities. Additional milestones included a 5% increase in managed services revenue and notable growth in ad and monetization streams. Upwork's advancements in AI-related services highlight its commitment to building value through innovation and market share growth.

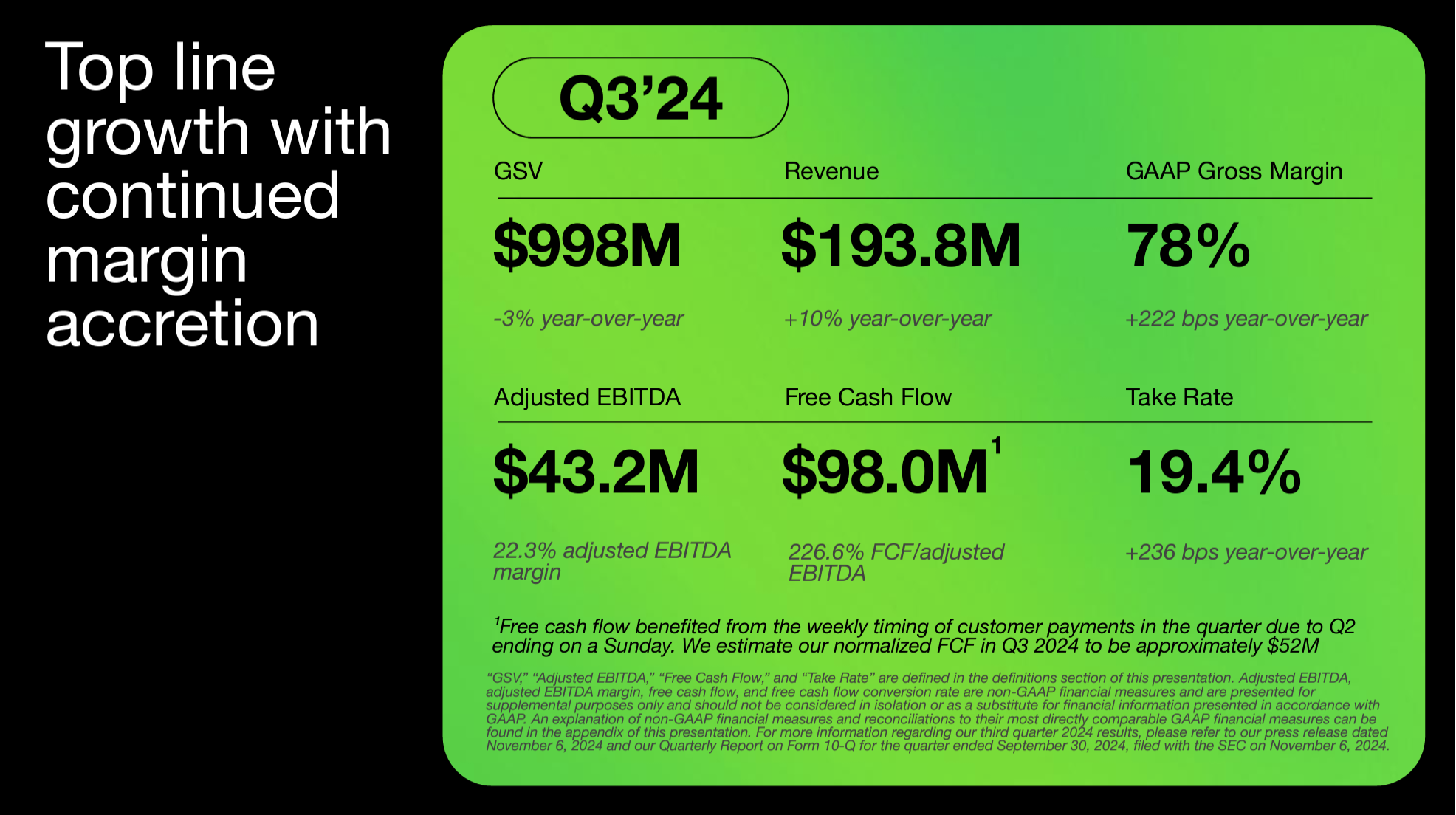

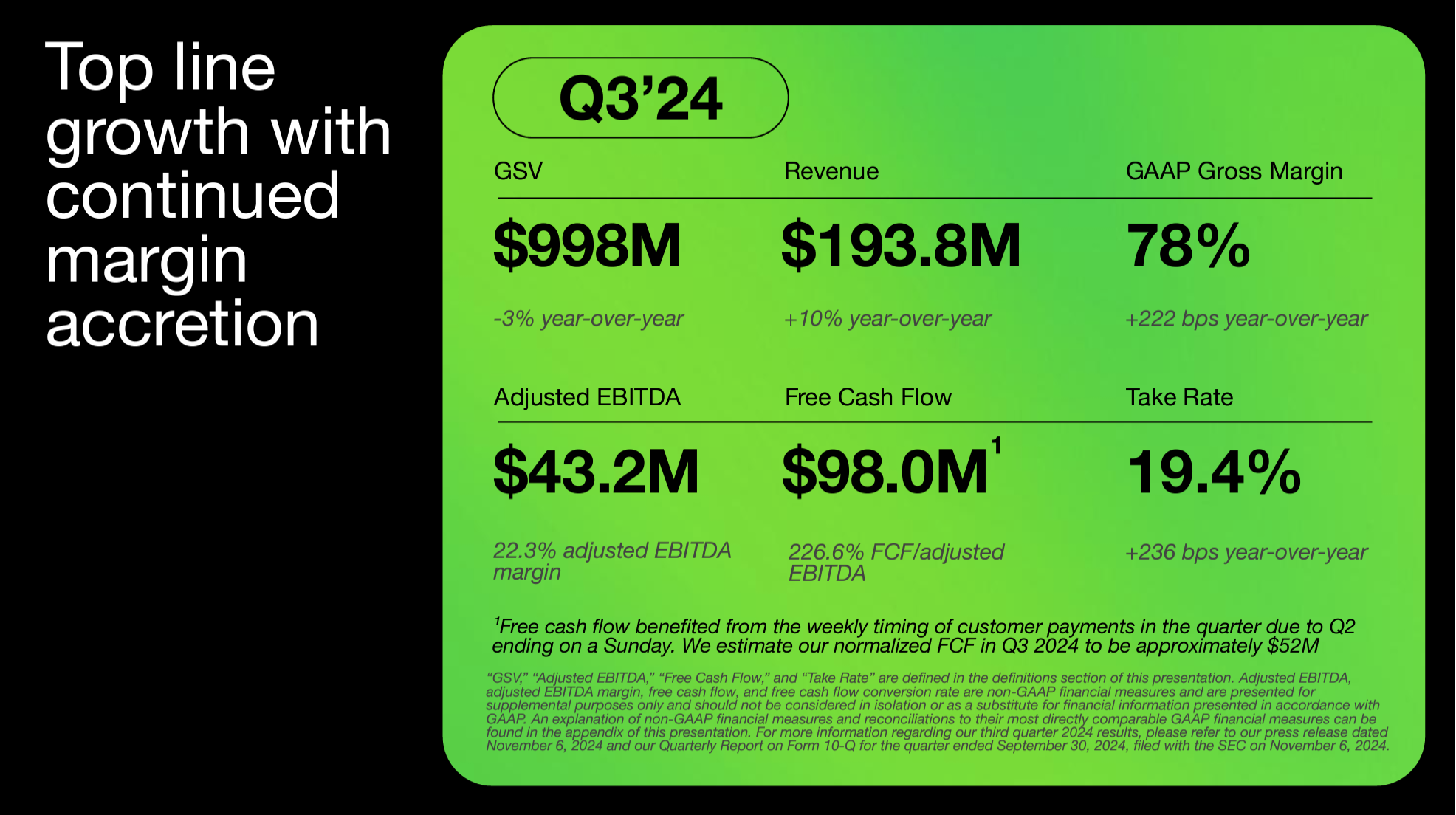

Achieves 10% year-over-year revenue growth, record GAAP net income of $27.8 million and adjusted EBITDA of $43.2 million

Third-quarter GAAP diluted EPS of $0.20

Raises FY 2024 guidance for revenue and adjusted EBITDA

Enters definitive agreement to acquire Objective to enhance core search and match offerings and strengthen AI talent bench

Announces new $100 million share repurchase program authorization

Achieves 10% year-over-year revenue growth, record GAAP net income of $27.8 million and adjusted EBITDA of $43.2 million

Third-quarter GAAP diluted EPS of $0.20

Raises FY 2024 guidance for revenue and adjusted EBITDA

Enters definitive agreement to acquire Objective to enhance core search and match offerings and strengthen AI talent bench

Announces new $100 million share repurchase program authorization

SAN FRANCISCO, Nov. 06, 2024 - Upwork Inc. (Nasdaq: UPWK), the world’s largest work marketplace that connects businesses with independent talent from across the globe, today announced its financial results for the third quarter of 2024.

“Upwork continues to seize the tremendous market opportunity and execute our strategy to deliver durable, profitable growth, with 10% year-over-year revenue growth and our highest-ever net income in the third quarter,” said Hayden Brown, president and CEO, Upwork. “We are building long-term shareholder value by serving clients with work outcomes on demand, produced by the world’s most skilled freelance professionals working hand-in-hand with cutting-edge AI tools. This quarter, our AI-powered innovation accelerated, with new capabilities for Uma™, Upwork’s Mindful AI, that streamline key steps in matching with and hiring talent as well as delivering outcomes in both our Marketplace and Managed Services offerings.”

“As we raise our full-year 2024 revenue and adjusted EBITDA guidance, the resilient performance of our business and our continued market share gains in the face of a challenging macro environment are remarkable. Underscoring our confidence in our strategy, our Board of Directors has authorized another $100 million share repurchase, positioning Upwork to build on our track record of returning meaningful capital to shareholders,” said Erica Gessert, CFO, Upwork. “Through our disciplined execution, we accomplished a record-high adjusted EBITDA margin of 22% in the third quarter. We are wholly committed to growing profitability, and have made great progress towards achieving our 35% adjusted EBITDA margin target in the next five years.”

Third Quarter Financial Highlights

- Revenue grew 10% year-over-year to $193.8 million in the third quarter of 2024

- Active clients grew 2% year-over-year to 855,000

- Net income reached an all-time high of $27.8 million in the third quarter of 2024, up 70% compared to net income of $16.3 million in the third quarter of 2023

- Diluted earnings per share was $0.20 in the third quarter of 2024, up 67% compared to diluted earnings per share of $0.12 in the third quarter of 2023

- Adjusted EBITDA1 was $43.2 million in the third quarter of 2024, up 38% compared to adjusted EBITDA of $31.2 million in the third quarter of 2023

- Cash provided by operating activities was $102.1 million in the third quarter of 2024, compared to cash provided by operating activities of $37.0 million in the third quarter of 2023

- Free cash flow1 was $98.0 million in the third quarter of 2024, compared to free cash flow of $33.4 million in the third quarter of 20232

Third Quarter Operational Highlights

Artificial Intelligence

Third Quarter Operational Highlights

Artificial Intelligence

- Launched enhancements for Uma™, Upwork’s Mindful AI, to create tailored proposal drafts for freelancers and evaluate candidates for clients based on how closely professionals’ skills and experience fit a job post.

- Premiered Uma™-powered Managed Services to more efficiently scope projects, evaluate skills, and design optimal teams of experts to deliver work outcomes.

- Uma™-enabled Job Post Generator helped clients complete job posts 73% faster than job posts in the quarter not leveraging Job Post Generator.

- GSV from AI-related work grew 36% year-over-year in the third quarter.

- Number of clients engaging in AI-related projects grew 30% year-over-year in the third quarter.

- Freelance professionals working on AI-related work earned 41% more per hour than freelancers working on non-AI-related work in the third quarter.

- Announced agreement to acquire Objective AI, Inc.3, an AI-native search-as-a-service company, to further enhance Upwork’s core search and match performance, strengthen Upwork’s AI and machine learning team, and continue upleveling multi-modal capabilities for Uma™ to assist customers with images, videos, and audio content.

Enterprise

- Continued success with a modified Enterprise offering, resulting in increased sales team win rates and 42 total new Enterprise clients, including Hunter Douglas, Bill.com, Berlitz, and Guess.

- Grew Managed Services revenue 5% year-over-year in the third quarter, reflecting increasing demand for delivery of work outcomes and strong pipeline of new Managed Services clients.

Ads & Monetization

- Continued strength in ads & monetization, with revenues increasing 35% year-over-year in the third quarter.

- Freelancer Plus subscription revenue increased 48% year-over-year in the third quarter.

Partnerships

- Partnered with emergent tech providers including Lettuce, Ocoya, TheWordsmith and Builderall to offer fully-managed projects delivered by Upwork embedded directly within partners’ customer experiences, expanding access to Upwork services and skilled talent beyond Upwork’s platform.

- Welcomed Webflow, Smartsheet, Bubble, General Assembly and more to Upwork Partner Experts program, providing clients access to pre-vetted specialist talent on Upwork.

Financial Guidance & Outlook

Upwork announced the authorization of a new $100 million share repurchase program, following the completion of a previous $100 million authorization earlier this year.

Upwork’s guidance for revenue, adjusted EBITDA, diluted weighted-average shares outstanding, and non-GAAP diluted EPS for the fourth quarter of 2024 is:

- Revenue: $178 million to $183 million

- Adjusted EBITDA: $38 million to $42 million4

- Diluted weighted-average shares outstanding: 140 million to 142 million

- Non-GAAP diluted EPS: $0.24 to $0.26

Upwork’s guidance for revenue, adjusted EBITDA, diluted weighted-average shares outstanding, non-GAAP diluted EPS, and stock-based compensation expense for full year 2024 is:

- Revenue: $756 million to $761 million

- Adjusted EBITDA: $155 million to $159 million

- Diluted weighted-average shares outstanding: 139 million to 141 million

- Non-GAAP diluted EPS: $1.00 to $1.02

- Stock-based compensation expense is expected to be lower than previous guidance of $20 million per quarter in 2024

______________________

1 An explanation of non-GAAP financial measures and reconciliations to their most directly comparable GAAP financial measures can be found in the “Non-GAAP Financial Measures" section and the subsequent tables at the end of this press release.

2 Free cash flow benefited from the weekly timing of customer payments in the quarter due to Q2 ending on a Sunday.

3 The transaction is expected to close in the fourth quarter of 2024, subject to the satisfaction of customary closing conditions.

4 Adjusted EBITDA guidance does not include one-time restructuring charges related to the organizational changes announced on October 23, 2024.

Third Quarter 2024 Financial Results Conference Call and Webcast

Upwork will host a conference call today at 2:00 p.m. Pacific Time/5:00 p.m. Eastern Time to discuss the company’s third quarter 2024 financial results. An audio webcast archive will be available following the live event for approximately one year at investors.upwork.com. Please visit the Upwork Investor Relations website at investors.upwork.com/financial-information/quarterly-results to view Upwork’s third quarter 2024 earnings presentation.

Disclosure Information

We use our Investor Relations website (investors.upwork.com), our Blog (upwork.com/blog), our X handle (twitter.com/Upwork), Hayden Brown’s X handle (twitter.com/hydnbrwn) and LinkedIn profile (linkedin.com/in/haydenlbrown), and Erica Gessert’s LinkedIn profile (linkedin.com/in/erica-gessert) as means of disseminating or providing notification of, among other things, news or announcements regarding our business or financial performance, investor events, press releases, and earnings releases, and as means of disclosing material nonpublic information and for complying with our disclosure obligations under Regulation FD.

About Upwork

Upwork is the world’s largest work marketplace that connects businesses with independent talent from across the globe. We serve everyone from one-person startups to large, Fortune 100 enterprises with a powerful, trust-driven platform that enables companies and talent to work together in new ways that unlock their potential. Our talent community earned over $3.8 billion on Upwork in 2023 across more than 10,000 skills in categories including website & app development, creative & design, data science & analytics, customer support, finance & accounting, consulting, and operations. Learn more at upwork.com and join us on LinkedIn, Facebook, Instagram, TikTok, and X.

Contact:

Investor Relations

investor@upwork.com

Safe Harbor:

This press release of Upwork Inc. (the “Company,” “we,” “us,” or “our”) contains "forward-looking" statements within the meaning of the federal securities laws. Forward-looking statements include all statements other than statements of historical fact, including any statements regarding our future operating results and financial position, including expected financial results for the fourth quarter and full year 2024, information or predictions concerning the future of our business or strategy, anticipated events and trends, potential growth or growth prospects, competitive position, technological and market trends, including artificial intelligence, industry environment, the economy, our plans with respect to share repurchases, the expected impact of cost-saving initiatives, our planned acquisition of Objective AI, Inc., and other future conditions.

We have based these forward-looking statements largely on our current expectations and projections as of the date hereof about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. As such, they are subject to inherent uncertainties, known and unknown risks, and changes in circumstances that are difficult to predict and in many cases outside our control, and you should not rely on such forward-looking statements as predictions of future events. We make no representation that the projected results will be achieved or that future events and circumstances will occur, and actual results may differ materially and adversely from our expectations. The forward-looking statements are made as of the date hereof, and we do not undertake, and expressly disclaim, any obligation to update or revise any forward-looking statements, to conform these statements to actual results, or to make changes in our expectations, except as required by law. Additional information regarding the risks and uncertainties that could cause actual results to differ materially from our expectations is included under the caption "Risk Factors" in our Quarterly Report on Form 10-Q for the three months ended June 30, 2024, filed with the SEC on August 7, 2024, and in our other SEC filings, which are available on our Investor Relations website at investors.upwork.com and on the SEC’s website at www.sec.gov. Additional information will also be set forth under the caption “Risk Factors” in our Quarterly Report on Form 10-Q for the three months ended September 30, 2024, when filed.

All third-party trademarks, including names, logos, and brands, referenced in this press release are property of their respective owners. All references to third-party trademarks are for identification purposes only and shall be considered nominative fair use under trademark law.