Zoho Launches Zoho Payroll, a Comprehensive Solution That Simplifies Payroll Processing and Compliance for Businesses in the United States

Zoho Corporation has launched the US edition of Zoho Payroll, providing an all-in-one solution for simplifying payroll management, automating tax compliance, and connecting HR and financial operations. This release enhances Zoho's robust finance and operations suite, including Zoho Books, Zoho Inventory, and Zoho Practice, enabling seamless interoperability and empowering SMBs with tools to optimize financial efficiency, ensure compliance, and streamline processes.

AUSTIN, Texas-

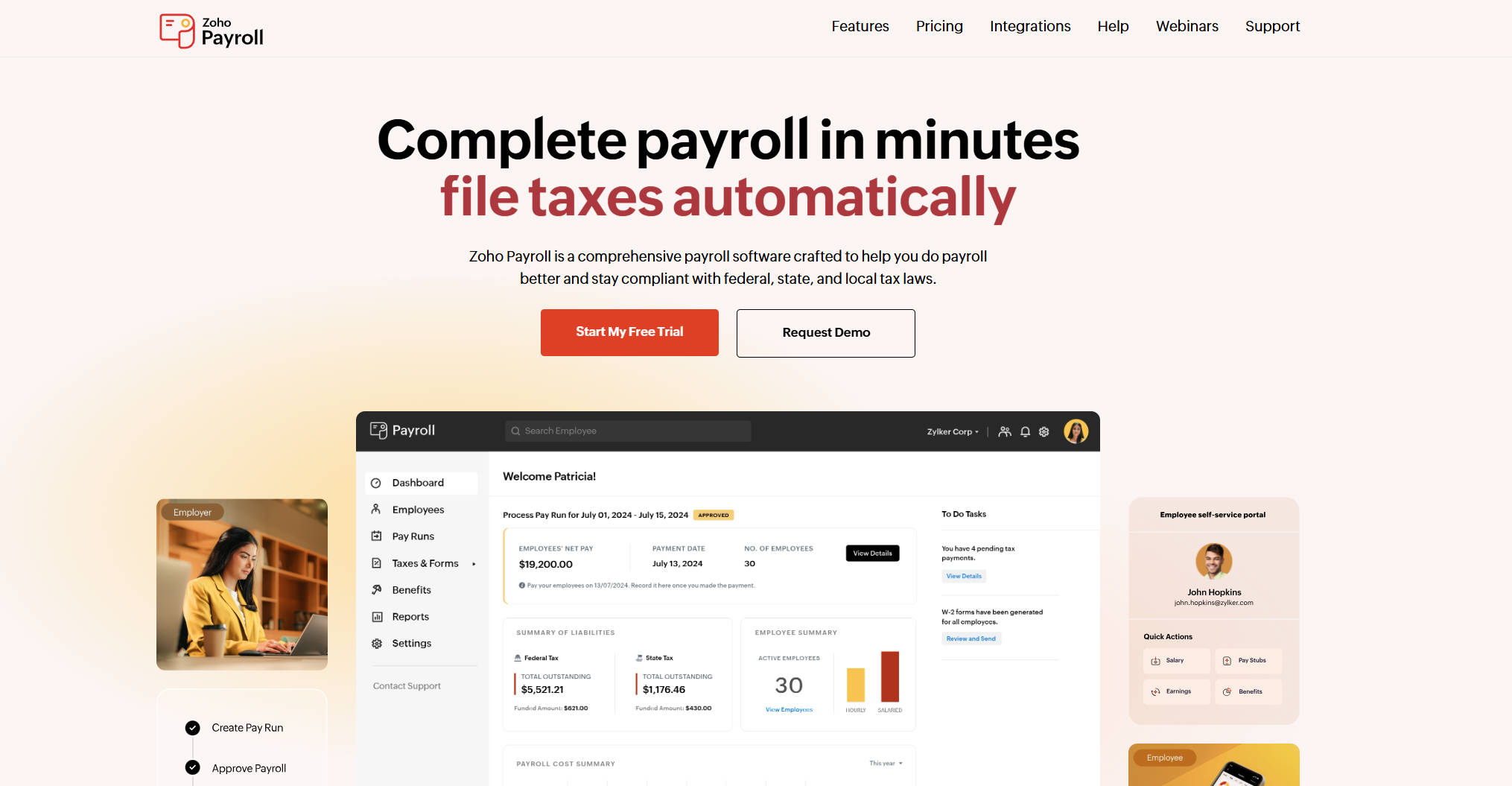

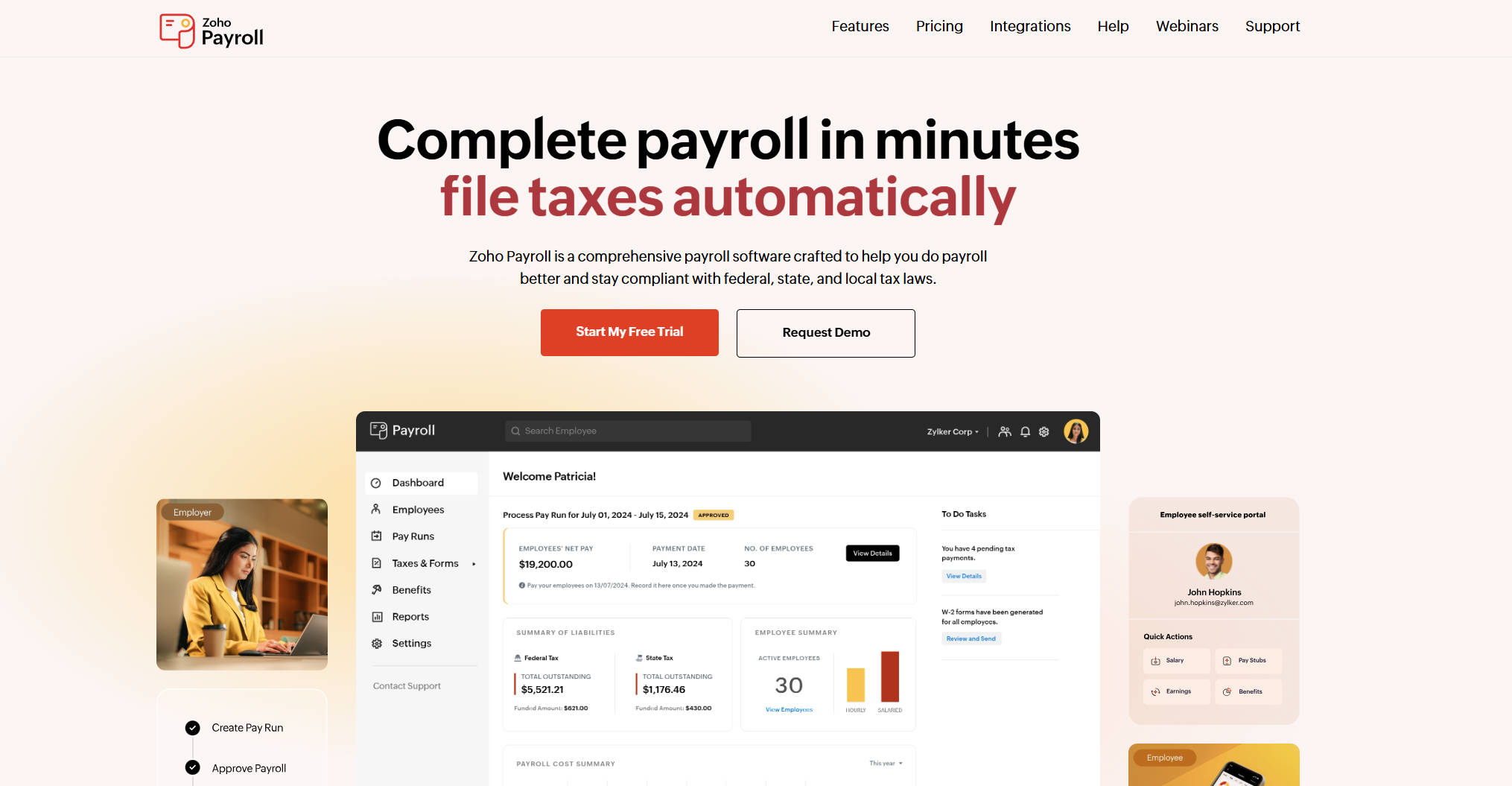

Zoho Corporation, a global technology company, today announced the US edition of

Zoho Payroll, an end-to-end solution that streamlines payroll management, ensures compliance, automates tax payments and filing, and eliminates operational silos between departments handling employee data, financial records, and payment processes.

The launch is accompanied by advancements to Zoho's existing suite of finance solutions:

Zoho Books,

Zoho Inventory, and

Zoho Practice. Together with Payroll, these apps form the core of Zoho's finance and operations platform—offering an interconnected, one-stop solution for managing an organization's financial and operational processes.

"Few existing finance solutions offer seamless interoperability, requiring customers to install multiple pieces of software and contend with organizational silos," says

Raju Vegesna, Chief Evangelist at Zoho. "Zoho Payroll addresses the struggles our customers were facing in finding a system to keep up with endless revisions to tax codes, maintain accuracy and compliance across departments, and generate financial reports. The growth of our array of finance apps is driven by our customers, and that will never change."

Zoho's Payroll addresses a need in the market for a full-featured and holistic product that seamlessly connects with other relevant systems. According to Deloitte’s Global Payroll Benchmarking Survey, while 73% of organizations outsource aspects of their payroll process, they still identify key areas for improvement such as compliance, self-service, and technology integration. Meanwhile, smaller businesses have limited options and often rely on manually intensive and error-prone solutions.

Zoho Payroll provides a comprehensive solution designed to automate payroll processing, offer contextually well-connected systems, and fulfill compliance obligations. The key capabilities of Zoho Payroll include:

- Simplified federal, state, and local tax compliance across all 50 states with automated calculating, paying, and filing of taxes

- Efficient handling of employee benefits, including healthcare, retirement savings, paid time off (PTO), and managing contributions to an employee's 401(k), 403(b), health savings accounts (HSA), and flexible spending accounts (FSA), as configured

- Mobile-first employee self-service portal, available on iOS and Android devices, enables employees to view payslips, benefits contributions, and salary breakdowns, modify tax withholding preferences, and communicate with HR

- Integration with Zoho People, Zoho Expense, and Zoho Books, enabling automatic syncing of employee data, initiation of expense reimbursements, and posting of payroll journal entries

Major Enhancements to Zoho's Finance and Operations Platform

Many businesses rely on manual processes for performing critical financial tasks, resulting in delays, errors, and inefficiencies that drive up costs and hinder growth. Today's updates to Zoho's finance and operations platform aim to streamline these processes for greater efficiency for both businesses and accountants.

For businesses:

Zoho Books has introduced a suite of new features, including support for direct filing of 1099-MISC and 1099-NEC with the IRS, with provisions for collecting and managing W-9 forms from contractors. Progress-based invoicing allows businesses to invoice customers incrementally, improving cash flow. With bill pay capabilities, businesses can autoscan bills, set up vendor approval flows, perform 3-way match for accuracy, and process batch payments, simplifying the entire accounts payable process. Advanced features include revenue recognition, which automatically recognizes revenue based on contractual obligations or when the service is delivered, and fixed asset management, allowing the recording of asset details, automatic depreciation calculations, and the generating of forecast reports, simplifying the bookkeeping process.

In

Zoho Inventory, advanced warehouse management capabilities—such as enhanced location tracking and labeling, stock counting, stock out alerts, and role-based access to the warehouse operations—offer better inventory control, ensure accurate stock levels, and provide faster order processing. The product’s mobile apps empower warehouse employees to perform their tasks more efficiently, improving productivity.

For accountants:

Zoho Practice has included new features to help accountants deliver client services efficiently. Workpapers simplifies audit and compliance workflows by automatically fetching client financial statements from Zoho Books, enabling easy comparison, adjustments, document management, and collaboration for seamless review and approval. The self-service portal enables accountants to collaborate with clients that use third-party services, facilitating document requests, digital signatures, and communication. Accountants can easily create and manage ledgers without a full accounting system, helping them maintain a single source truth. Advanced capabilities like workflow automation, custom functions, and scheduling options support a complete tailoring of their operational workflow.

Pricing and Availability

Zoho Payroll is available for immediate use in all 50 states. Pricing starts at $39 per month. For more information, please visit: https://www.zoho.com/us/payroll/pricing/.

All features announced today for Zoho Books, Zoho Inventory, and Zoho Practice are available for use. For more details on pricing, please visit the following pages for each product:

Zoho Books, Zoho Inventory, Zoho Practice.

Analyst Statements (In Alphabetical Order by Firm Name)

"Zoho Payroll US Edition provides tremendous value to payroll and finance executives who demand stability as much as flexibility in scaling out their HR needs. The new US Payroll release, in conjunction with other financial management tools from Zoho, gives fast-growing organizations greater control over their payroll function while expanding their operations globally simultaneously. The standard packaging of Zoho's multinational HR, financial management and native hyperscaler support represents a security blanket so that companies can spend more time taking care of their customers and employees than managing disparate tools and inconsistent services from different Cloud providers and outsourcers.'' --

Apps Run The World, Albert Pang, President

"With payroll often the largest operating expense for most organizations and touching every corner of the business, modernizing the critical process and its compliance is increasingly essential. The addition of U.S. payroll to an already extensive Zoho suite of finance and HR applications is well-timed in meeting the growing demand among emerging SMBs for unified, cloud-based solutions. By seamlessly integrating native payroll capabilities, the Zoho suite offers a robust end-to-end capability that further solidifies its position as a leading all-in-one platform." --

Payroll Influences, Pete Tiliakos, Principal Analyst

“SMB’s need more than a simple gross-to-net pay calculation tool. They need a solution that does more: a full self-service/mobile capability, tax filing support, and integrations to their financial applications. A more complete design helps eliminate a lot of non-value-added activity – something SMB’s can’t afford and lack the time or personnel to support. This upgrade makes Zoho’s solutions for US-based firms functionally, technically and economically more attractive.” --

TechVentive, Brian Sommer, Founder and Chief Analyst

"With Payroll, Zoho is extending its capabilities for HR and finance with business-critical payroll capabilities, enabling customers to further leverage Zoho's platform to run their businesses and reduce the complexity associated with managing the accounting around most businesses' largest budget item - labor." --

Valoir Research, Rebecca Wettemann, CEO & Principal Analyst

Disclaimer: All trademarks, product names, and company names cited herein are the property of their respective owners.

Zoho Privacy Pledge

Zoho is committed to user privacy and does not rely on an ad-revenue business model. The company owns and operates its data centers, providing full oversight of customer data privacy and security. Over 100 million users globally, across hundreds of thousands of companies, trust Zoho to run their businesses, including Zoho itself. For more information, please visit: https://www.zoho.com/privacy-commitment.html.

About Zoho

With over 55 apps across nearly every major business category,

Zoho Corporation is one of the world’s most prolific technology companies. Headquartered in Austin, Texas, with international headquarters in Chennai, India, Zoho is privately held and profitable, employing more than 15,000 people worldwide. For more information, visit

www.zoho.com.