Capitalize Secures $19M to Revolutionize 401(k) Rollovers with Digital Innovation

Capitalize, a platform that facilitates the digital transfer and management of retirement assets, announced the closure of a $19 million Series B funding round led by RRE Ventures. This investment will accelerate the adoption of their technology, which has already seen a sixfold increase in rollover volume over the past 18 months. Capitalize's platform, which simplifies the traditionally cumbersome 401(k) rollover process, is now handling billions of dollars in annual transactions. The new funds will be used to enhance their core platform, expand services to both partners and consumers, and grow their Enterprise business, which integrates their technology into leading financial institutions' onboarding processes.

Capitalize Rollover Volume Has Grown Over 6x In Last 18 Months, Now Processing Several Billion Dollars In Retirement Account Transfers Annually

Capitalize Rollover Volume Has Grown Over 6x In Last 18 Months, Now Processing Several Billion Dollars In Retirement Account Transfers Annually

NEW YORK--

Capitalize, the first platform to help consumers and financial institutions digitally find and transfer retirement assets, today announced the close of a $19 million Series B funding round, led by RRE Ventures. The round included participation from existing Capitalize investors including Canapi Ventures and Bling Capital, and new investors including Industry Ventures.

Since launching in 2020, Capitalize has rapidly expanded its platform to digitally locate and transfer legacy retirement accounts, and is now processing several billion dollars of rollover volume annually. Both rollover volume on the Capitalize platform and Capitalize’s revenue have grown by approximately 6x in the last 18 months.

A significant driver of Capitalize’s recent growth has been its

Enterprise business, which allows leading financial institutions to embed Capitalize’s rollover technology directly into their onboarding and funding flows, helping their customers find and transfer legacy employer-sponsored retirement accounts such as 401(k)s into a new account of their choice. Capitalize now offers a full suite of enterprise-grade APIs, led by the recent launch of its

Embedded Rollover API, which allows partners to leverage Capitalize technology to power rollovers in a native, seamless way.

“We’re thrilled to be partnering with RRE for this latest funding round, a firm we’ve long admired for their mission-driven approach and deep expertise within financial services and fintech,” said Gaurav Sharma, co-founder and CEO of Capitalize. “Together we’re excited to keep modernizing the antiquated rollover process so that Americans can better move and manage their money, and our partners can serve their users more efficiently.”

Each year, millions of Americans change jobs and either leave behind or prematurely cash out their 401(k) account. Others are forced to endure the manual “401(k) rollover” process to transfer their assets into a new retirement account. Historically, the rollover process has imposed a significant administrative burden on individuals, forcing them to contact multiple financial institutions, fill out tedious paperwork, handle phone calls, and often receive and forward physical checks. The result is that more than 29 million Americans have forgotten or left behind over $1.65 trillion in 401(k) assets in their former employer’s plan. The rollover process has also made it harder for consumer-focused financial institutions to fund new retirement accounts and grow their retirement assets. Capitalize’s proprietary rollover technology solves this problem for both individuals and retirement account providers by digitizing the approximately $1 trillion of 401(k) rollovers that occur annually.

“We’re honored to support Capitalize in its journey to bring retirement account transfers into the digital age”, said Raju Rishi, General Partner at RRE Ventures. “We’ve known Gaurav and the Capitalize team since 2020, and have been incredibly impressed by the thoughtful, systematic approach they’ve taken to building a great company in this important industry.”

Capitalize will use the new capital to accelerate technology investment in its core rollover platform and expand to serve both partners and consumers with additional features and transfer types. The funding will also be used to support ongoing growth in new and existing Enterprise partners, and serve additional segments of the market, including financial advisors and recordkeepers.

About Capitalize

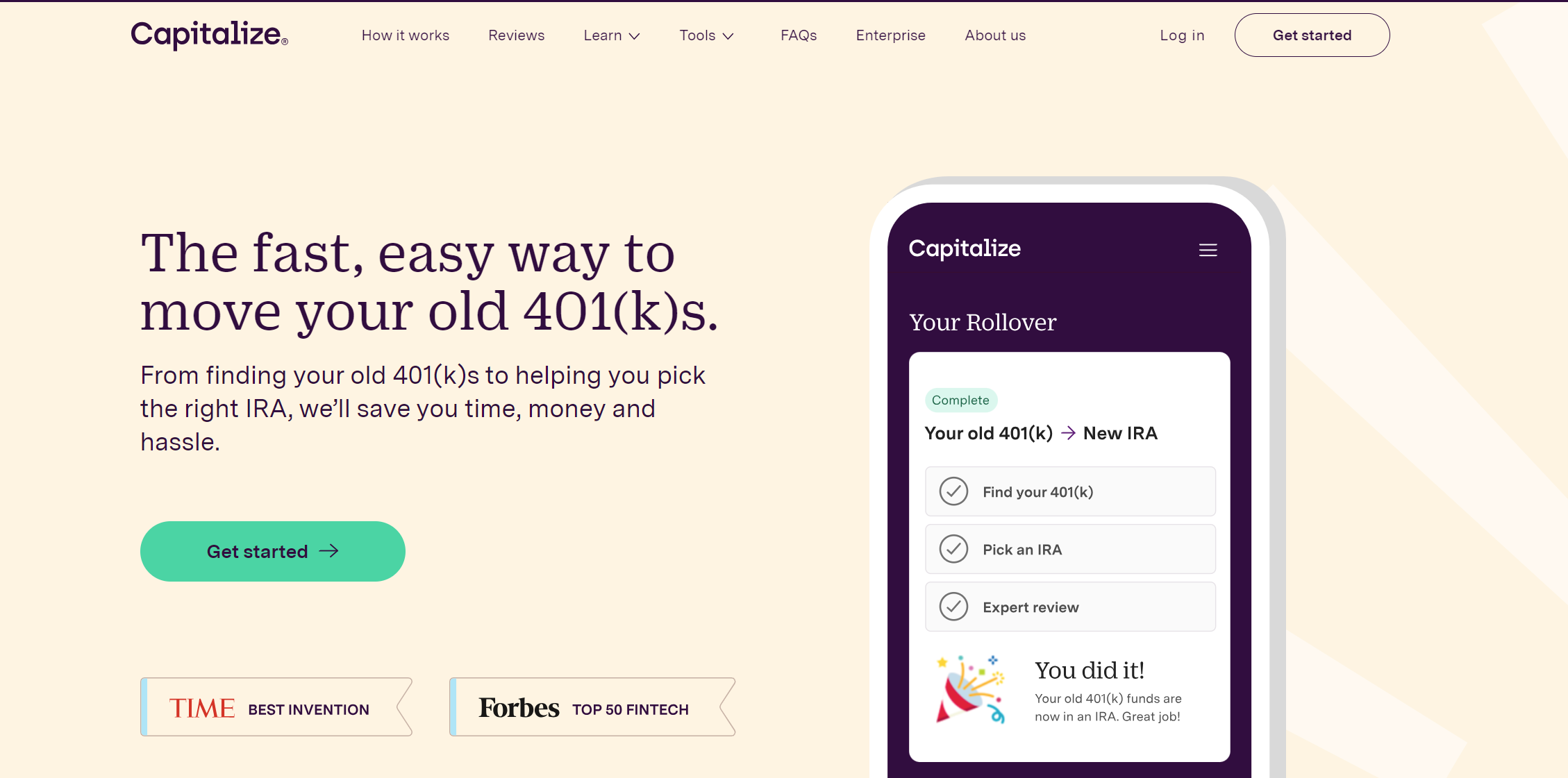

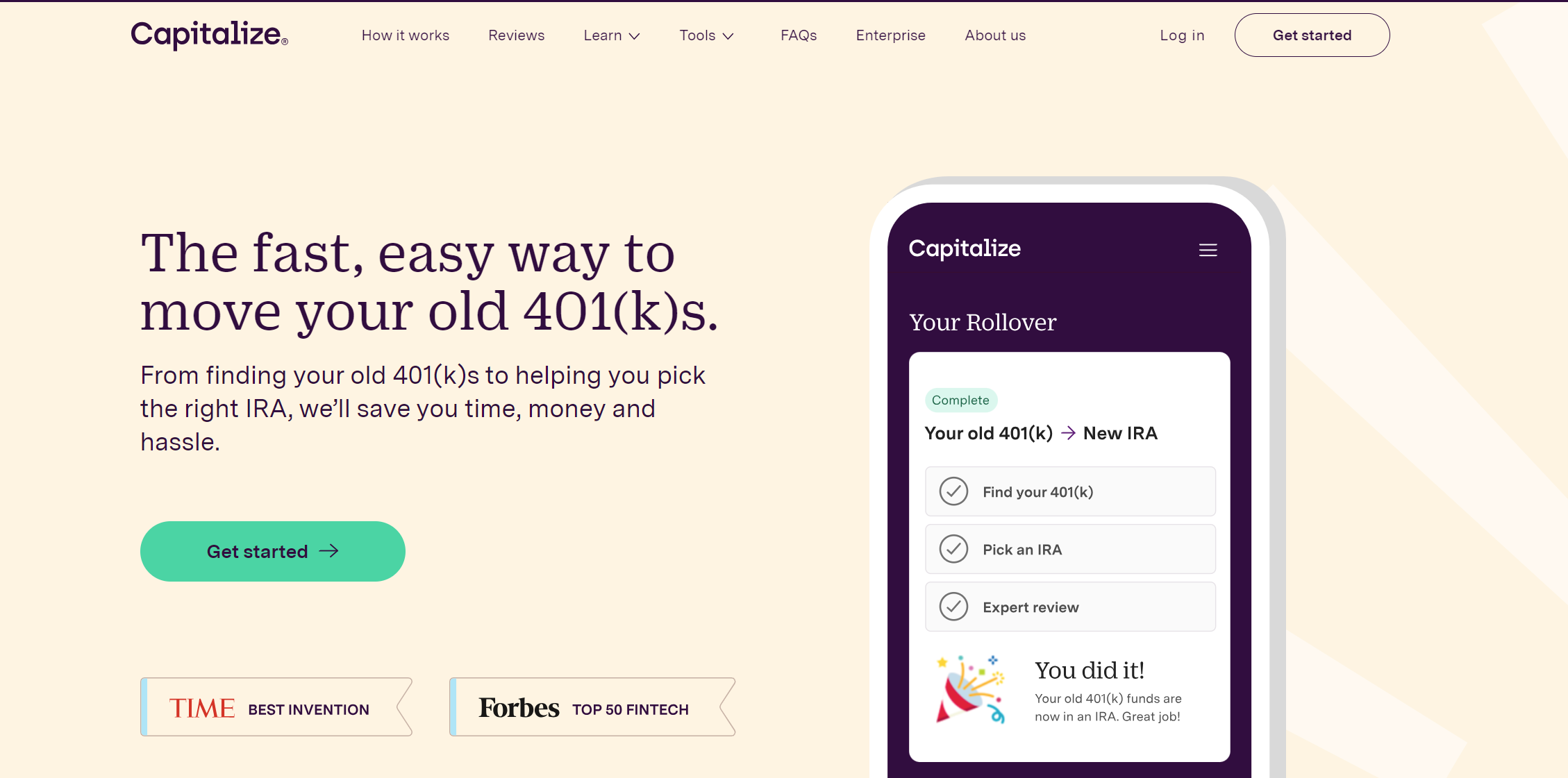

Capitalize is the first platform to help consumers and their financial institutions digitally locate and transfer retirement assets, such as 401(k)s. Capitalize’s technology is used by leading financial institutions to power rollovers natively for their users and is also available to consumers directly. Capitalize helps Americans better save for retirement by ensuring that they can easily find, transfer, and keep track of their retirement assets. Capitalize has been recognized as one of

TIME’s 100 Best Inventions, as well as by

Fast Company as a World Changing Idea and

Forbes as one of the Top 50 Fintech Companies in the US.

About RRE Ventures

RRE Ventures is a pioneering early-stage venture capital firm, based in New York City, that has established itself as a top performer over the past two decades. Managing over $2 billion across eight funds, the firm has made 340 investments since its inception, with over 120 active portfolio companies. The experienced, high-touch team, led by hands-on general partners, offers unparalleled access to Fortune 500 companies and is backed by world-class limited partners and advisors.

About Canapi Ventures

Canapi Ventures is a venture capital firm investing in early to growth-stage fintech companies. Our partners have been at the forefront of financial services innovation as operators, investors, bankers, advisors, and regulators. Our venture capital model connects high-quality fintech companies to our extensive network of banks and strategic partners. Canapi Ventures is advised by CenterHarbor Advisors. For more information, visit canapi.com.

About Bling Capital

Bling Capital is an early stage venture fund founded in 2018 by Ben Ling, a former product executive at Google, Facebook, and YouTube. Since inception, Bling Capital has backed over 100 companies that have collectively raised over $2B. Bling Capital offers a unique Product Council of 100+ top executives as resources to its portfolio companies. We are honored to have been featured by TechCrunch as “The VCs that Founders Love the Most” and Ben Ling was ranked every year the Midas Seed List has been published, most recently at #4 and #5 (2022, 2023, 2024).