Docebo Reports $57M Q4 Revenue & $217M Annual Revenue, Driven by AI-Powered Learning

Docebo Inc. (NASDAQ: DCBO; TSX: DCBO), a leader in AI-driven learning platforms, reported strong financial results for Q4 and fiscal year 2024. The company achieved $57 million in Q4 total revenue (16% YoY growth) and $216.9 million for the year (20% YoY growth). Subscription revenue remains dominant, comprising 95% of total revenue. Net income surged to $11.9 million in Q4, while ARR reached $219.7 million. The company launched three key AI-powered products: AI Authoring, Advanced Analytics, and Communities, enhancing enterprise learning experiences. Docebo continues to strengthen its position in the learning technology market with an optimistic 2025 financial outlook, forecasting subscription revenue growth between 11.5%-14.0% after currency adjustments.

TORONTO---

Docebo Inc. (NASDAQ: DCBO; TSX:DCBO) (“

Docebo” or the “

Company”), a leading learning platform provider with a foundation in artificial intelligence (AI) and innovation, announced financial results for the three months and fiscal year ended December 31, 2024. All amounts are expressed in US dollars unless otherwise stated.

“We are pleased to announce Q4 and annual results, with revenue beating our expectations and profitability coming in at the high end of our guidance even as we invest in our growth initiatives. Our AI-driven platform continues to differentiate Docebo with the capabilities to support complex, multi-use case requirements,” stated Alessio Artuffo, President and CEO. “Our competitive position continued to gain strength with the successful launch of three new products: AI Authoring, Advanced Analytics, and Communities. The positive response from customers and channel partners is strengthening our enterprise pipeline, setting us up for solid growth in the year ahead.”

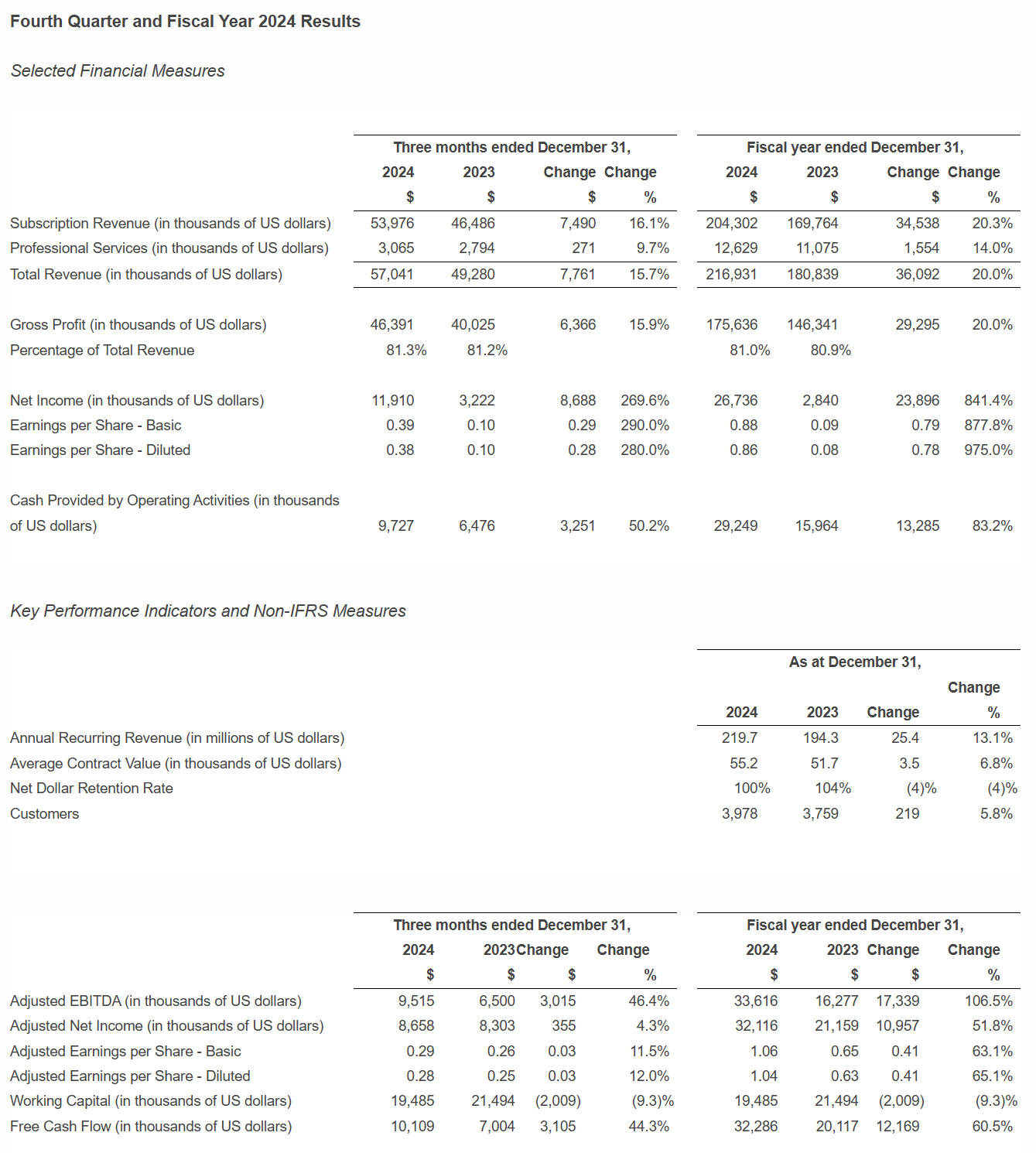

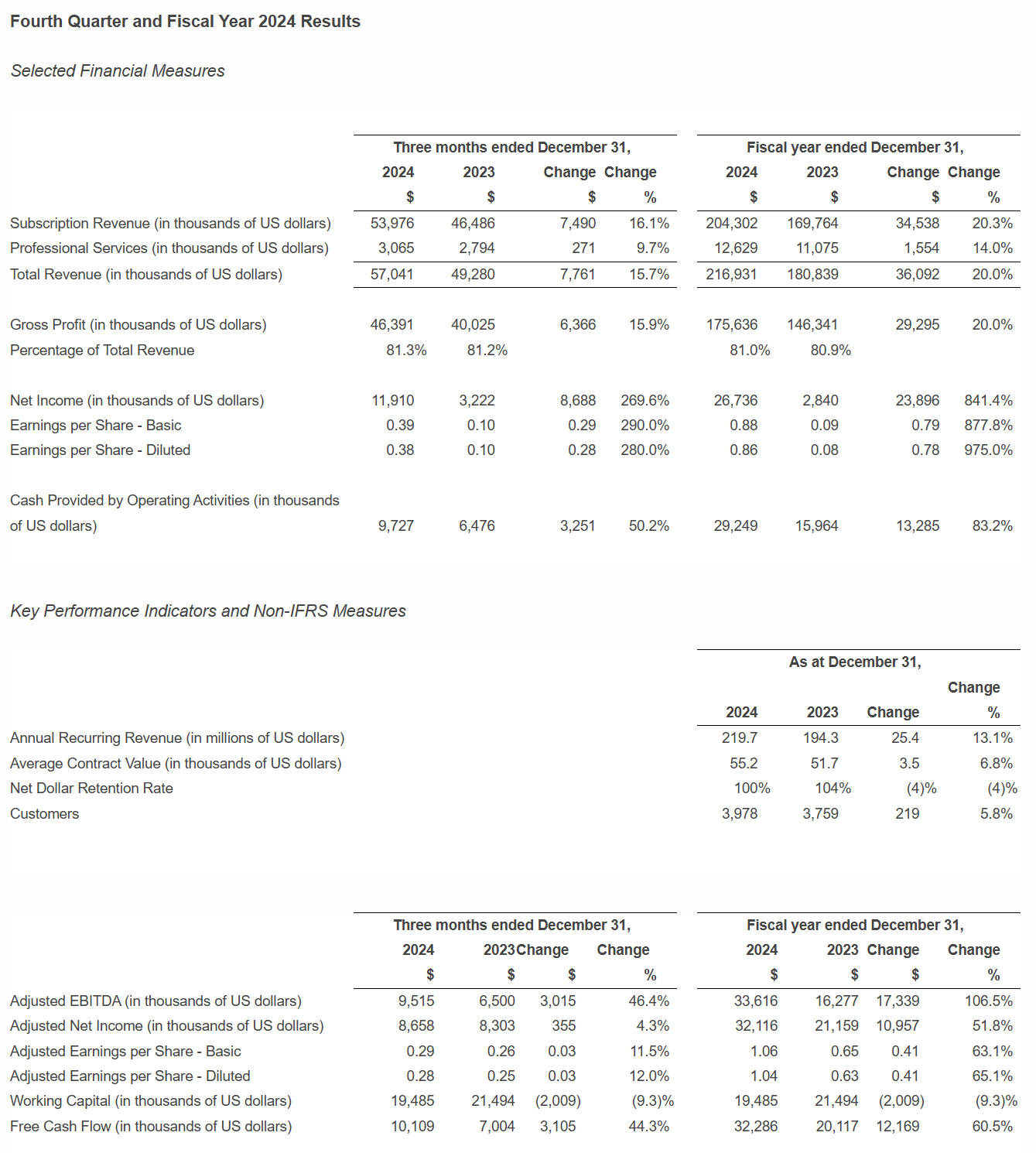

Fourth Quarter 2024 Financial Highlights

- Subscription revenue of $54.0 million, an increase of 16% from the comparative period in the prior year, represented 95% of total revenue.

- Total revenue of $57.0 million, an increase of 16% from the comparative period in the prior year.

- Gross profit of $46.4 million, an increase of 16% from the comparative period in the prior year, represented 81.3% of revenue compared to 81.2% of revenue for the comparative period in the prior year.

- Net income of $11.9 million, or $0.39 per share, compared to net income of $3.2 million, or $0.10 per share for the comparative period in the prior year.

- Adjusted Net Income1 of $8.7 million, or Adjusted Earnings per share of $0.29, compared to Adjusted Net Income of $8.3 million, or Adjusted Earnings per share of $0.26 for the comparative period in the prior year.

- Annual Recurring Revenue (“ARR”)1 of $9.2 million added during the quarter, compared to $10.8 million for the comparative period in the prior year, in each case after adjusting for foreign currency exchange impacts.

- As at December 31, 2024, ARR was $219.7 million, an increase of $25.4 million from $194.3 million as at the end of the fourth quarter of 2023.

- Adjusted EBITDA1 of $9.5 million, representing 16.7% of total revenue, compared to $6.5 million, representing 13.2% of total revenue, for the comparative period in the prior year.

- Cash flow from operating activities of $9.7 million, compared to $6.5 million for the comparative period in the prior year.

- Free Cash Flow1 of $10.1 million, representing 17.7% of total revenue for the three months ended December 31, 2024, compared to $7.0 million, representing 14.2% of total revenue, for the comparative period in the prior year.

Fiscal Year 2024 Financial Highlights

- Subscription revenue of $204.3 million, an increase of 20% from the comparative period in the prior year, represented 94% of total revenue.

- Total revenue of $216.9 million, an increase of 20% from the comparative period in the prior year.

- Gross profit of $175.6 million, an increase of 20% from the comparative period in the prior year, represented 81.0% of revenue compared to 80.9% of revenue for the comparative period in the prior year.

- Net income of $26.7 million, or $0.88 per share, compared to net income of $2.8 million, or $0.09 per share, for the comparative period in the prior year.

- Adjusted Net Income1 of $32.1 million, or Adjusted Earnings per share of $1.06, compared to Adjusted Net Income1 of $21.2 million, or Adjusted Earnings per share of $0.65 for the comparative period in the prior year.

- Net Dollar Retention Rate1 as at December 31, 2024 of 100% compared to 104% at December 31, 2023.

- Adjusted EBITDA1 of $33.6 million, representing 15.5% of total revenue, compared to Adjusted EBITDA1 of $16.3 million, representing 9.0% of total revenue, for the comparative period in the prior year.

- Cash flow generated from operating activities of $29.2 million, compared to $16.0 million for the comparative period in the prior year.

- Free Cash Flow1 of $32.3 million, representing 15% of total revenue, compared to $20.1 million, representing 11% of total revenue, for the comparative period in the prior year.

- Cash and cash equivalents of $92.5 million as at December 31, 2024 compared to $72.0 million as at December 31, 2023.

Fourth Quarter 2024 Business Highlights

- Docebo is now used by 3,978 customers, an increase from 3,759 customers at the end of December 31, 2023.

- Average Contract Value1, calculated as total Annual Recurring Revenue divided by the number of active customers, is $55,229 as at December 31, 2024 an increase from $51,689 as at December 31, 2023.

- Notable new customer wins in the quarter include the YMCA of the USA (Y-USA), the national resource office for the YMCA dedicated to strengthening community, chose Docebo to upgrade their learning & knowledge platform from a legacy, internally developed LMS. Working with one of our large systems integrator partners, an immersive analysis was undertaken in order to better understand the organization’s immediate and longer-term learning Employee Experience (EX) needs for onboarding, compliance and leadership training use cases.

- Xponential Fitness, Inc. one of the leading global franchisors of boutique health and wellness brands, operates a diversified platform of nine brands spanning across verticals including Pilates, indoor cycling, barre, stretching, dancing, boxing, strength training, metabolic health, and yoga. Docebo’s EX capabilities were chosen to replace a legacy platform because of its configurability in addressing each unique health and wellness brand with a modern, easy to use platform able to deliver the curated learning experiences crucial to the training of Xponential’s franchisees.

- A large multinational vertically integrated oil and gas company headquartered in Europe working with a large systems integrator partner selected Docebo to address a Customer Experience (CX) use case to train petrol station and automobile service franchisees across Europe with the plan to expand the program globally.

- lululemon athletica inc. is a technical athletic apparel, footwear, and accessories company for yoga, running, training, and most other activities. Having initially partnered with Docebo for EX use cases that included onboarding, compliance and a mobile application to train their retail associates in 2021, they expanded their use of the Docebo learning & knowledge platform when they added a CX use case designed to train vendors as a means to improve supply chain management processes.

- Docebo expanded its learner base at Databricks, a data and AI company for a second time in 2024. Databricks deployed Docebo’s learning platform to support several CX and EX use cases including partner and customer training, sales enablement, professional development, leadership training, onboarding and compliance.

1 Please refer to “Non-IFRS Measures and Reconciliation of Non-IFRS Measures” section of this press release.

Financial Outlook

Docebo is providing financial guidance for the fiscal year ending December 31, 2025 as follows:

- Subscription revenue growth of 11.5% to 12.5% or 13.0% to 14.0% after adjusting for negative impact of 1.5% resulting from the strengthening of the U.S. dollar relative to foreign currencies

- Total revenue growth between 11.0% and 12.0% or 12.5% to 13.5% after adjusting for negative impact of 1.5% resulting from the strengthening of the U.S. dollar relative to foreign currencies

- Adjusted EBITDA as a percentage of total revenue between 18.0% and 19.0%

Docebo is providing financial guidance for the three months ended March 31, 2025 as follows:

- Total revenue between $57.0 million and $57.2 million which includes an approximately 1.5% negative impact resulting from the strengthening of the U.S. dollar relative to foreign currencies

- Adjusted EBITDA as a percentage of total revenue between 14.5% to 15.0%

The information in this section is forward-looking. Please see the sections entitled “Non-IFRS Measures and Reconciliation of Non-IFRS Measures” and “Key Performance Indicators” in this press release for how we define “Adjusted EBITDA” and the section entitled “Forward-Looking Information.” A reconciliation of forward-looking “Adjusted EBITDA” to the most directly comparable IFRS measure is not available without unreasonable effort, as certain items cannot be reasonably predicted because of their high variability, complexity and low visibility. Docebo believes that this type of guidance provides useful insight into the anticipated performance of its business.

Conference Call

Conference Call

Management will host a conference call on Friday, February 28, 2025 at 8:00 am ET to discuss these fourth quarter and fiscal year results. To access the conference call, please dial +1-646-960-0169 or +1-888-440-6849 or access the webcast at

https://docebo.inc/events-and-presentations/default.aspx. The Company will post Prepared Management Remarks (in .pdf format) regarding its Q4-2024 results, which will be the subject of this call, on the Investor Relations section of Docebo’s website at

https://investors.docebo.com.

The consolidated financial statements for the fiscal year ended December 31, 2024 and Management’s Discussion & Analysis for the same period have been filed on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Alternatively, these documents along with a presentation in connection with the conference call can be accessed online at

https://investors.docebo.com.

An archived recording of the conference call will be available until March 7, 2025 and for 90 days on our website. To listen to the recording, please visit the webcast link which can be found on Docebo’s investor relations website at

https://docebo.inc/events-and-presentations/default.aspx or call +1-609-800-9909 or +1-800-770-2030 and enter passcode 8722408#.

Forward-Looking Information

This press release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking information”) within the meaning of applicable securities laws.

In some cases, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects”, “is expected”, “an opportunity exists”, “budget”, “scheduled”, “estimates”, “outlook”, “forecasts”, “projection”, “prospects”, “strategy”, “intends”, “anticipates”, “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or, “will”, “occur” or “be achieved”, and similar words or the negative of these terms and similar terminology. In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding future events or circumstances.

This forward-looking information in this press release includes, but is not limited to, statements regarding the Company’s business; the guidance for the three months ended March 31, 2025 in respect of total revenue, Adjusted EBITDA as a percentage of total revenue and subscription revenue and fiscal year ending December 31, 2025 in respect of total revenue growth, and Adjusted EBITDA as a percentage of total revenue discussed under “Financial Outlook” in this press release; the impact of AI on our business; future financial position and business strategy; the learning management industry; our growth rates and growth strategies; addressable markets for our solutions; the achievement of advances in and expansion of our platform; expectations regarding our revenue and the revenue generation potential of our platform and other products; our business plans and strategies; and our competitive position in our industry. This forward-looking information is based on our opinions, estimates and assumptions in light of our experience and perception of historical trends, current conditions and expected future developments, as well as other factors that we currently believe are appropriate and reasonable in the circumstances. Despite a careful process to prepare and review the forward-looking information, there can be no assurance that the underlying opinions, estimates and assumptions will prove to be correct. Certain assumptions include: our ability to build our market share and enter new markets and industry verticals; our ability to attract and retain key personnel; our ability to maintain and expand geographic scope; our ability to execute on our expansion plans; our ability to continue investing in infrastructure to support our growth; our ability to obtain and maintain existing financing on acceptable terms; our ability to execute on profitability initiatives; currency exchange and interest rates; the impact of inflation and global macroeconomic conditions; the impact of competition; our ability to respond to the changes and trends in our industry or the global economy; and the changes in laws, rules, regulations, and global standards are material factors made in preparing forward-looking information and management’s expectations.

Forward-looking information is necessarily based on a number of opinions, estimates and assumptions that, while considered by the Company to be appropriate and reasonable as of the date of this press release, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including but not limited to:

- the Company’s ability to execute its growth strategies;

- the impact of changing conditions in the global corporate e-learning market;

- increasing competition in the global corporate e-learning market in which the Company operates;

- fluctuations in currency exchange rates and volatility in financial markets;

- changes in the attitudes, financial condition and demand of our target market;

- the Company’s ability to operate its business and effectively manage its growth under evolving macroeconomic conditions, such as high inflation and recessionary environments;

- developments and changes in applicable laws and regulations;

- fluctuations in the length and complexity of the sales cycle for our platform, especially for sales to larger enterprises;

- issues in the use of AI in our platform and potential resulting reputational harm or liability;

- such other factors discussed in greater detail under the “Risk Factors” section of our Annual Information Form dated February 27, 2025 (“AIF”), which is available under our profile on SEDAR+ at www.sedarplus.ca.

Our guidance for the three months ended March 31, 2025 in respect of total revenue, Adjusted EBITDA as a percentage of total revenue and subscription revenue and fiscal year ending December 31, 2025 in respect of total revenue, and Adjusted EBITDA as a percentage of total revenue is subject to certain assumptions and associated risks as stated above under this “Forward-Looking Information,” section and in particular the following:

- currency assumptions, in particular that the US dollar will remain strong against other major currencies;

- there will be continued macro-economic headwinds that will specifically affect our small and medium sized business and lower mid-market customers;

- there will be a seven-figure negative impact on our Annual Recurring Revenue base resulting from a large enterprise customer terminating its agreement with us following its acquisition of an organization that has an in-house LMS;

- our ability to win business from new customers and expand business from existing customers;

- the timing of new customer wins and expansion decisions by our existing customers;

- maintaining our customer retention levels, and specifically, that customers will renew contractual commitments on a periodic basis as those commitments come up for renewal, at rates not materially inconsistent with our historical experience; and

- with respect to Adjusted EBITDA as a percentage of revenue, our ability to contain expense levels while expanding our business.

If any of these risks or uncertainties materialize, or if the opinions, estimates or assumptions underlying the forward-looking information prove incorrect, actual results or future events might vary materially from those anticipated in the forward-looking information. The opinions, estimates or assumptions referred to above and described in greater detail in the “Summary of Factors Affecting our Performance” section of our MD&A for the three months and fiscal year ended December 31, 2024 and in the “Risk Factors” section of our AIF, should be considered carefully by prospective investors.

Although we have attempted to identify important risk factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other risk factors not presently known to us or that we presently believe are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking information. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. No forward-looking statement is a guarantee of future results. Accordingly, you should not place undue reliance on forward-looking information, which speaks only as of the date made. The forward-looking information contained in this press release represents our expectations as of the date specified herein, and are subject to change after such date. However, we disclaim any intention or obligation or undertaking to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required under applicable securities laws.

All of the forward-looking information contained in this press release is expressly qualified by the foregoing cautionary statements.

Additional information relating to Docebo, including our AIF, can be found on SEDAR+ at www.sedarplus.ca.

About Docebo

Docebo is redefining the way enterprises leverage technology to create and manage content, deliver training, and measure the business impact of their learning programs. With Docebo’s end-to-end learning platform, organizations worldwide are equipped to deliver scaled, personalized learning across all their audiences and use cases, driving growth and powering their business.