Fiverr International Ltd. announced robust financial results for Q3 2024, highlighting a revenue increase to $99.6 million and a notable rise in adjusted EBITDA. The company outperformed expectations amidst a challenging macro environment, reflecting the success of its strategic initiatives such as enhancing value-added services and venturing upmarket. Fiverr launched Dynamic Matching, an AI tool aimed at improving buyer and project matching for complex requirements. This innovation, along with expansions like the Business Rewards Program, aims to cultivate a higher-quality, higher-spending buyer base. The company also raised its full-year guidance based on strong Q3 performance, signaling confidence in its long-term growth trajectory facilitated by strategic investments and product innovations.

- Delivered both revenue and Adjusted EBITDA above guidance range: We continue to execute with focus and efficiency, delivering exceptional results amid a challenging macro environment. Our strategy to lean into value-added services to drive take rate expansion continues to pay off, and we continue to invest in going upmarket to unlock long-term growth opportunities.

- Growing a high-quality buyer base: We continue to grow wallet share among our customers, with spend per buyer up 9% y/y in Q3’24. The recently rolled out Business Rewards Program on Fiverr Pro is showing promising signs to drive spending growth among larger customers, leading to more buyers spending over $10K on Fiverr annually.

- Creating end-to-end experience to enable complex projects: We launched Dynamic Matching, an AI-powered tool to provide a seamless matching experience for buyers with complex job requirements. Together with Professions Catalog and Hourly-Based Contracts, we are enabling an end-to-end experience for businesses to search, find, and engage with talent for complex projects and longer duration.

- Raising full-year guidance: The strong performance in Q3 gave us confidence to raise our full-year guidance range for both revenue and Adjusted EBITDA. This also translates into strong cash flow generation and puts us well on track to deliver the three-year targets on Adjusted EBITDA and free cash flow that we laid out last quarter.

NEW YORK, Oct. 30, 2024 -

Fiverr International Ltd. (NYSE: FVRR), the company that is changing how the world works together, today reported financial results for the third quarter 2024. Additional operating results and management commentary can be found in the Company’s shareholder letter, which is posted to its investor relations website at

investors.fiverr.com.

“Our strong Q3 results underscored the consistency of our execution and the resilience of our business. We have a clear strategy for driving growth catalysts amid the uncertain macro environment. The investments we made in strengthening our value-added product portfolio have clearly paid off, as we continue to diversify our business model and expand into a platform where businesses can lean into both technology and human experts,” said Micha Kaufman, founder and CEO of Fiverr. “In addition, we are laying critical product foundations for us to appeal to larger customers and projects, which we expect to unlock significant long-term growth opportunities down the road. The integration of GenAI technology allows us to develop groundbreaking products that were not possible before. I’m really proud of our team who work around the clock to build these amazing experiences for our customers.”

"I’m pleased to report an exceptional quarter with both top and bottom lines exceeding expectations. The strong results and our continued progress on profitability improvements put us well on track to achieve our three-year targets for Adjusted EBITDA and free cash flow,” said Ofer Katz, President and CFO of Fiverr. “With a strong balance sheet and free cash flow generation, we have ample cash to address outstanding convertible notes, while having sufficient liquidity to run our business, and additional capacity to return capital to our shareholders. We are fortunate to have the optionality and we will continue to execute a disciplined capital allocation strategy to drive long-term shareholder value.”

Third Quarter 2024 Financial Highlights

- Revenue in the third quarter of 2024 was $99.6 million, compared to $92.5 million in the third quarter of 2023, an increase of 8% year over year.

- Active buyers1 as of September 30, 2024 was 3.8 million, compared to 4.2 million as of September 30, 2023, a decline of 9% year over year.

- Spend per buyer1 as of September 30, 2024 reached $296, compared to $271 as of September 30, 2023, an increase of 9% year over year.

- Take rate1 for the period ended September 30, 2024 was 33.9%, up from 31.3% for the period ended September 30, 2023, an increase of 260 basis points year over year.

- GAAP gross margin in the third quarter of 2024 was 81.0%, a decrease of 270 basis points from 83.7% in the third quarter of 2023. Non-GAAP gross margin1 in the third quarter of 2024 was 84.0%, a decrease of 120 basis points from 85.2% in the third quarter of 2023.

- GAAP net income in the third quarter of 2024 was $1.4 million, or $0.04 basic and diluted net income per share, compared to $3.0 million net income, or $0.08 basic net income per share and $0.07 diluted net income per share in the third quarter of 2023.

- Non-GAAP net income1 in the third quarter of 2024 was $24.6 million, or $0.69 basic non-GAAP net income per share1 and $0.64 diluted non-GAAP net income per share1, compared to $22.6 million non-GAAP net income, or $0.59 basic non-GAAP net income per share1 and $0.55 diluted non-GAAP net income per share1, in the third quarter of 2023.

- Net cash provided by operating activities in the third quarter of 2024 was $10.9 million. Net cash provided by operating activities, excluding one-time escrow payment for contingent consideration of $12.2 million, was $23.0 million in the third quarter of 2024, compared to $23.4 million in the third quarter of 2023.

- Free cash flow in the third quarter of 2024 was $10.6 million. Free cash flow, excluding one-time escrow payment for contingent consideration of $12.2 million, was $22.7 million in the third quarter of 2024, compared to $23.1 million in the third quarter of 2023.

- Adjusted EBITDA1 in the third quarter of 2024 was $19.7 million, compared to $16.5 million in the third quarter of 2023. Adjusted EBITDA margin1 was 19.7% in the third quarter of 2024, compared to 17.9% in the third quarter of 2023, representing a 180 basis points improvement y/y.

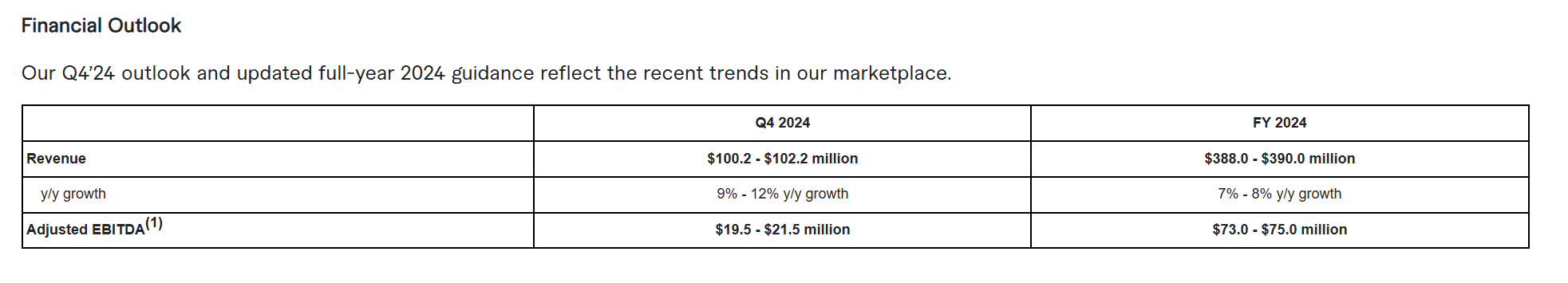

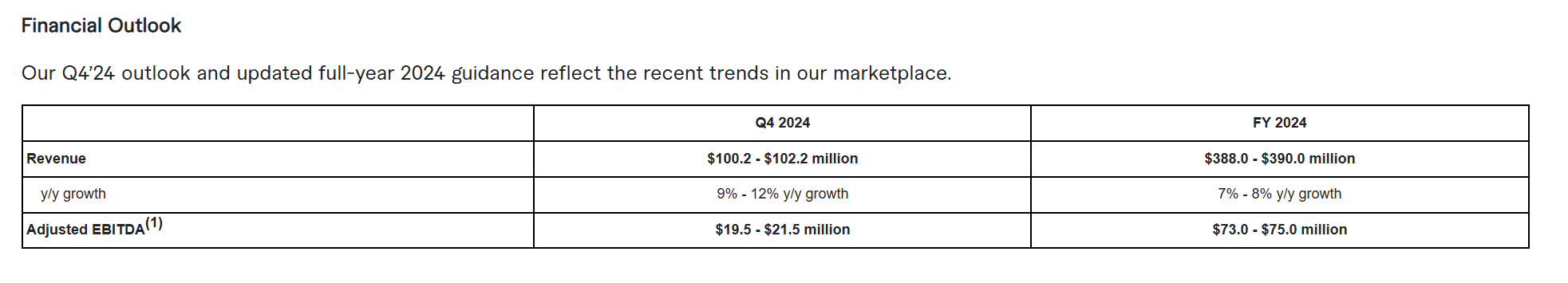

Financial Outlook

Our Q4’24 outlook and updated full-year 2024 guidance reflect the recent trends in our marketplace.

Conference Call and Webcast Details

Fiverr’s management will host a conference call to discuss its financial results on Wednesday, October 30, 2024, at 8:30 a.m. Eastern Time. A live webcast of the call can be accessed from Fiverr’s

Investor Relations website. An archived version will be available on the website after the call. To participate in the conference call, please register using the link

here.

About Fiverr

Fiverr’s mission is to change how the world works together. We exist to democratize access to talent and to provide talent with access to opportunities so anyone can grow their business, brand, or dreams. From small businesses to Fortune 500, around 3.8 million customers worldwide worked with freelance talent on Fiverr in the past year, ensuring their workforces remain flexible, adaptive, and agile. With Fiverr Business Solutions, large companies can find the right talent and tools, tailored to their needs to help them thrive and grow. On Fiverr, you can find over 700 skills, ranging from programming to 3D design, digital marketing to content creation, from video animation to architecture.