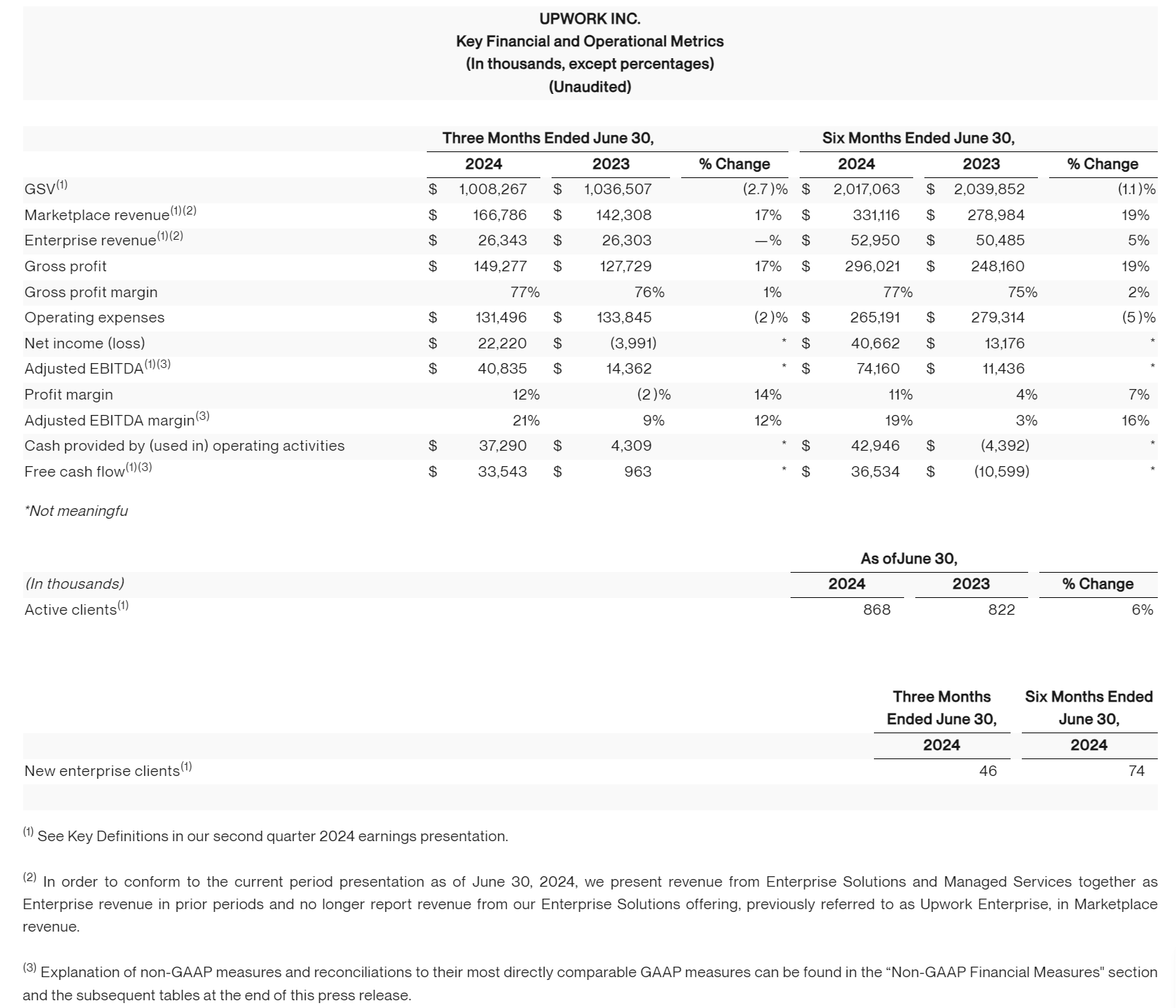

Upwork Inc. (Nasdaq: UPWK), reported its financial results for Q2 2024, showcasing a robust performance with a record GAAP net income of $22.2 million and a 15% year-over-year revenue growth to $193.1 million. The company achieved a diluted EPS of $0.17 and an adjusted EBITDA of $40.8 million. Notably, Upwork saw significant growth in AI-related work and revenue from ads and monetization products. CEO Hayden Brown emphasized the strength of Upwork's model in navigating a dynamic macroeconomic environment, while CFO Erica Gessert highlighted improved profit margins and operating efficiencies. The company returned $33.1 million to shareholders through share repurchases and remains optimistic about achieving a 35% adjusted EBITDA margin within the next five years.

Second-quarter GAAP Net Income of $22.2 million, Upwork’s highest ever

Second-quarter GAAP Diluted EPS of $0.17

Second-quarter Adjusted EBITDA of $40.8 million

Second Quarter 2024 Financial Results Conference Call and Webcast

Upwork will host a conference call today at 2:00 p.m. Pacific Time/5:00 p.m. Eastern Time to discuss the company’s second quarter 2024 financial results. An audio webcast archive will be available following the live event for approximately one year at investors.upwork.com. Please visit the Upwork Investor Relations website at investors.upwork.com/financial-information/quarterly-results to view Upwork’s second quarter 2024 earnings presentation.

Disclosure Information

We use our Investor Relations website (investors.upwork.com), our Blog (upwork.com/blog), our X handle (twitter.com/Upwork), Hayden Brown’s X handle (twitter.com/hydnbrwn) and LinkedIn profile (linkedin.com/in/haydenlbrown), and Erica Gessert’s LinkedIn profile (linkedin.com/in/erica-gessert) as means of disseminating or providing notification of, among other things, news or announcements regarding our business or financial performance, investor events, press releases, and earnings releases, and as means of disclosing material nonpublic information and for complying with our disclosure obligations under Regulation FD.

About Upwork

Upwork is the world’s largest work marketplace that connects businesses with independent talent from across the globe. We serve everyone from one-person startups to large, Fortune 100 enterprises with a powerful, trust-driven platform that enables companies and talent to work together in new ways that unlock their potential. Our talent community earned over $3.8 billion on Upwork in 2023 across more than 10,000 skills in categories including website & app development, creative & design, data science & analytics, customer support, finance & accounting, consulting, and operations. Learn more at upwork.com and join us on LinkedIn, Facebook, Instagram, TikTok, and X.

Contact:

Investor Relations

investor@upwork.com

Safe Harbor:

This press release of Upwork Inc. (the “Company,” “we,” “us,” or “our”) contains "forward-looking" statements within the meaning of the federal securities laws. Forward-looking statements include all statements other than statements of historical fact, including any statements regarding our future operating results and financial position, including expected financial results for the third quarter and full year 2024, information or predictions concerning the future of our business or strategy, anticipated events and trends, potential growth or growth prospects, competitive position, technological and market trends, including artificial intelligence, industry environment, the economy, our plans with respect to share repurchases, and other future conditions.

We have based these forward-looking statements largely on our current expectations and projections as of the date hereof about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. As such, they are subject to inherent uncertainties, known and unknown risks, and changes in circumstances that are difficult to predict and in many cases outside our control, and you should not rely on such forward-looking statements as predictions of future events. We make no representation that the projected results will be achieved or that future events and circumstances will occur, and actual results may differ materially and adversely from our expectations. The forward-looking statements are made as of the date hereof, and we do not undertake, and expressly disclaim, any obligation to update or revise any forward-looking statements, to conform these statements to actual results, or to make changes in our expectations, except as required by law. Additional information regarding the risks and uncertainties that could cause actual results to differ materially from our expectations is included under the caption "Risk Factors" in our Quarterly Report on Form 10-Q for the three months ended March 31, 2024, filed with the SEC on May 1, 2024, and in our other SEC filings, which are available on our Investor Relations website at investors.upwork.com and on the SEC’s website at www.sec.gov. Additional information will also be set forth under the caption “Risk Factors” in our Quarterly Report on Form 10-Q for the three months ended June 30, 2024, when filed.

All third-party trademarks, including names, logos, and brands, referenced in this press release are property of their respective owners. All references to third-party trademarks are for identification purposes only and shall be considered nominative fair use under trademark law.

Subscribe to our newsletter and never miss our latest digital HR news!

By signing up to receive DHRmap newsletter, you agree to our Terms of Use and Privacy Policy. You can unsubscribe anytime.